Quarter in Review

Global capital markets continued to struggle during the third quarter of 2022. Persistently hot inflation and the prospect of additional interest rate hikes continued to weigh on investor sentiment. Demand for goods and services remains strong despite higher interest rates while supply chains struggle to recover from the COVID pandemic. A brief rally early in the quarter faded on higher inflation readings and uncharacteristically blunt comments from Federal Reserve Chairman Jerome Powell who signaled that interest rates would continue to rise even if it meant a brief recession. The continuing conflict in Ukraine and its impact on global food and energy supplies has not helped, and a strong dollar (caused in large part by rapidly rising US interest rates) has impacted returns on international assets.

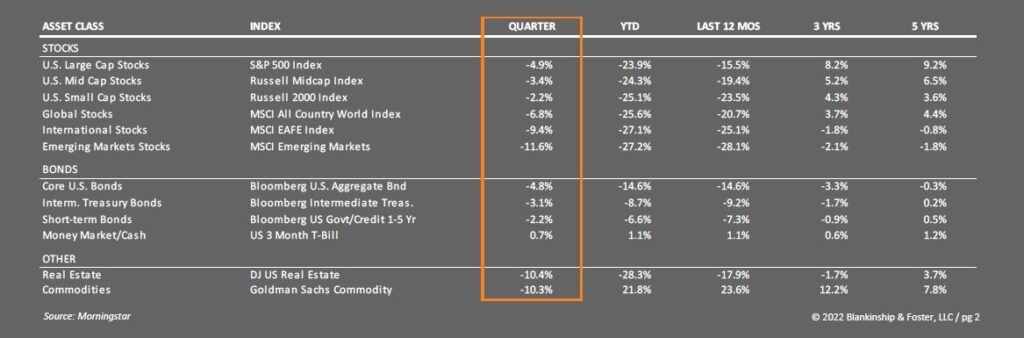

In the United States, rising interest rates, high inflation and sagging investor confidence led to continued declines across the board during the quarter. The S&P 500 index of large U.S. companies fell 4.9% for the quarter, down 23.9% year-to-date. Smaller companies lost 2.2% in the quarter and stocks of companies in developed non-U.S. countries dropped 9.4% in dollar terms (only -3.6% in local currency terms). The bond market continued to struggle as interest rates rose again during the quarter. The Bloomberg U.S. Aggregate index lost 4.8% in the quarter and is down 14.6% year-to-date. High yield “junk” bonds fared better, off 0.7% in the quarter. Cash was about the only bright spot in the third quarter, up 0.7% as higher short-term interest rates finally started to translate into gains for the shortest maturity securities.

We haven’t seen a year like this with such negative results for both stocks and bonds in the same year since the 1970’s.

Fiduciary

We are fiduciaries, and it’s not just a word. It’s a binding commitment to put your interests first.

Economy

When you’re flying an airplane, the term ‘behind the curve’ basically means that you are outside the safe operating parameters of the aircraft. It means that small mistakes can quickly become big ones and that the aircraft may react in unexpected ways to inputs like moving the controls. Today, the Federal Reserve is behind the curve when it comes to managing inflation. They are forced to over-react to persistently high inflation, and as a result, they are more likely to make a mistake. That mistake would be to cause a recession, rather than gently downshift the economy to slower growth and reduced inflation.

On the inflation front, factors like energy and vehicle prices have retreated in recent months, easing the upward pressure on inflation. Unfortunately, shelter costs, which tend to be a bit stickier, continue to rise. As a result, inflation may not abate as quickly as the Fed would like. Inflation expectations among consumers and investors remain somewhat muted, pointing to headline inflation of around 2.5-3% over the next five years.

That said, we take the Fed at its word that they will do whatever it takes to tame inflation. Unfortunately, that means that the likelihood of a recession in the next 12-18 months is significantly higher than it was at the beginning of the year. The economic indicators do not point to a recession today, as employment, consumer spending and other indicators remain either positive or not negative enough to signal a recession. While single family housing starts (new construction) are only just beginning to soften, multi-family housing starts are the highest they’ve been since the 1980s. Other indicators are equally mixed. The job market remains very strong, with almost 2 open jobs for every unemployed worker. This is likely a combination of strong demand for labor due to the booming economy of 2021 combined with a shortage of workers caused by baby boomer retirements and diminished legal immigration.

Global economic activity appears to be slowing. Europe and the UK have been hit badly by the sharp increase in energy prices following Russia’s invasion of Ukraine, and that’s not likely to improve in the coming months. In Asia, Chinese growth is also slowing markedly as a result of anti-COVID policies, attempts to rein in the housing bubble and other factors. A strong dollar is also putting pressure on overseas economies since it raises the input cost of commodities (including oil). This has also affected returns on international assets since returns earned in Euros or Yen are reduced when they are converted back into a stronger dollar.

FAQS

We’re happy to answer any questions you have about our firm and our processes. Here are answers to some of the questions we receive most frequently.

Outlook

The forecasts we read suggest positive economic growth in the third quarter, but weaker growth in the fourth quarter and 2023, though little change in the unemployment rate through the end of the year. The current expansion is slowing but still seems to have momentum. High interest rates have started to impact housing sales and demand, though haven’t seemed to have affected much else yet. This isn’t overly surprising, as it takes about 12 months for a change in interest rates to have a meaningful impact on the economy. The Fed has raised interest rates faster than any tightening cycle since 1945, so that speed may make a difference, but it hasn’t yet.

Looking forward to 2023 and beyond, there are reasons to expect that a recession may be relatively mild. The typical post-war recession has lasted about 10 months and resulted in a drop of about 3% of Gross Domestic Product. Housing, the epicenter of the last recession, and family balance sheets are in better shape this time around. Auto sales have been depressed for the past few quarters due to supply constraints, so pent-up demand should soften the normal weakness we would expect to see in a recession. The current labor market strength, which will admittedly weaken somewhat in a recession, could continue somewhat even as a recession begins, easing the impact somewhat.

With the increased possibility of a recession sometime in the next 12-18 months, we remain cautiously optimistic about prospects for capital markets. For one thing, the average recession since 1945 has been relatively brief (less than 12 months) and shallow. The average decline in stocks during a bear market (like we would expect in a recession) has been about 41%, and the S&P 500 is already off about 24% year-to-date. If a recession does happen, there will likely be more downside to come in stock prices, but it’s nearly impossible to predict when that will occur. More importantly, there will be ups and downs along the way, and missing just the 10 best days of investing over the last 20 years would have cut your return by about half. And many of those up days were in the middle of terrible bear markets.

Our Portfolios

Valuations for both U.S. and international stocks have improved significantly over the past few months. Our stock exposure is currently broad based and weighted towards large U.S. companies. Our value bias has helped improve performance despite the broad weakness of U.S. stock markets so far this year. Our international exposure benefitted from our blend of currency hedged investments, which outperformed as the dollar strengthened during the quarter. Improved valuations (much lower price to earnings multiples) suggests that stocks are poised for better performance over the next five to ten years, but a recession in the coming months or quarters will delay the start of any recovery in equity prices.

Our fixed income positions have struggled as interest rates rose faster than expected. However, the higher interest rates also mean that expected bond returns going forward are significantly better than they were this time last year. More importantly, if our expectation of a recession is realized, interest rates will likely settle back down, providing good returns to bonds.

Diversification has worked, even if the results this year are not particularly great. A portfolio of stocks and bonds has significantly outperformed the stock market this year, even after bonds’ terrible year. More importantly, not only is it very difficult to predict when the stock market will sell off in advance, it’s also incredibly difficult to predict when it will begin to recover. Every time there has been a recession since 1945, the stock market has begun to recover well before the economic indicators showed that the recession was ending. Studies have repeatedly shown that trying to time such shifts is nearly impossible, and that the better strategy is to select a good long-term allocation and stick to it, rebalancing along the way.

As always, we are here for you and are ready to provide the guidance and planning you expect from us. If you have any questions about your investments or your financial plan, we would love the opportunity to discuss them with you.

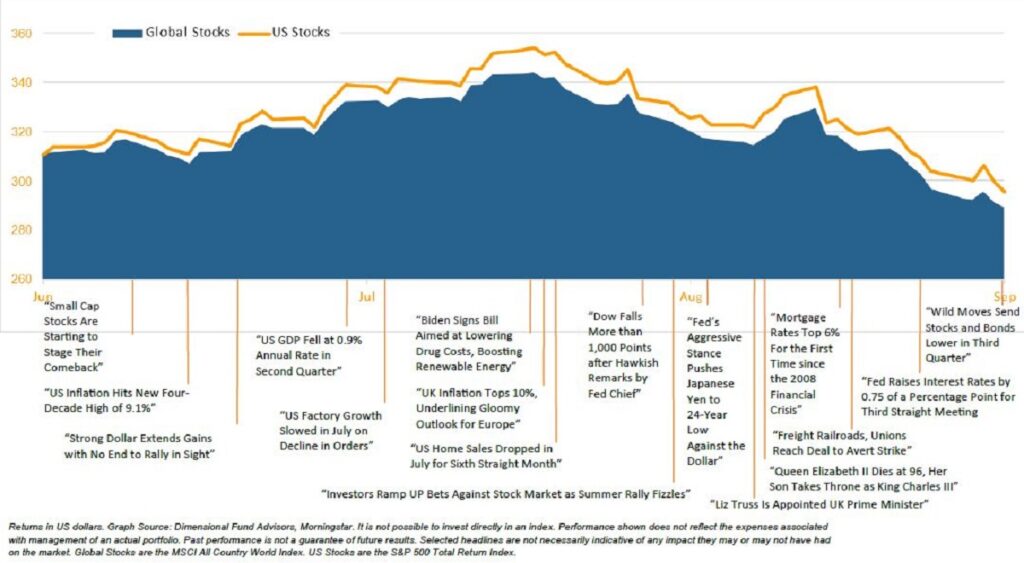

Global Stock Market Performance

The chart below shows the change in global equity markets throughout the quarter. Juxtaposed over the market performance are some of the key events that occurred during the period. Sometimes as we get to the end of a volatile period, it’s difficult to look back and remember everything that happened along the way.

Going Green

We have been working with our technology vendors and are excited to announce that we are able to deliver your quarterly reports to you via our secure online portal. This will help to save paper and is actually more secure, since you can only access the reports through a secure internet connection.

If you would like to save a few trees (and make the reports available whenever you’re ready to read them), then please email your advisor and ask about converting your reports to electronic delivery.

DISCLOSURE:

Past performance is not an indication of future returns. Information and opinions provided herein reflect the views of the author as of the publication date of this article. Such views and opinions are subject to change at any point and without notice. Some of the information provided herein was obtained from third-party sources believed to be reliable but such information is not guaranteed to be accurate.

The content is being provided for informational purposes only, and nothing within is, or is intended to constitute, investment, tax, or legal advice or a recommendation to buy or sell any types of securities or investments. The author has not considered the investment objectives, financial situation, or particular needs of any individual investor. Any forward-looking statements or forecasts are based on assumptions only, and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. Any assumptions and projections displayed are estimates, hypothetical in nature, and meant to serve solely as a guideline. No investment decision should be made based solely on any information provided herein.

There is a risk of loss from an investment in securities, including the risk of total loss of principal, which an investor will need to be prepared to bear. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular investor’s financial situation or risk tolerance.

Blankinship & Foster is an investment adviser registered with the Securities & Exchange Commission (SEC). However, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Complete information about our services and fees is contained in our Form ADV Part 2A (Disclosure Brochure), a copy of which can be obtained at www.adviserinfo.sec.gov or by calling us at (858) 755-5166, or by visiting our website at www.bfadvisors.com.