Quarter in Review

Perhaps the most important factor in the markets and the economy during the third quarter has been the surge of COVID cases caused by the Delta variant. The good news is that this wave of the pandemic seems to have peaked as hospitalizations are starting to trend down. This means that the economy can continue its journey back toward normal, or at least what counts as normal these days.

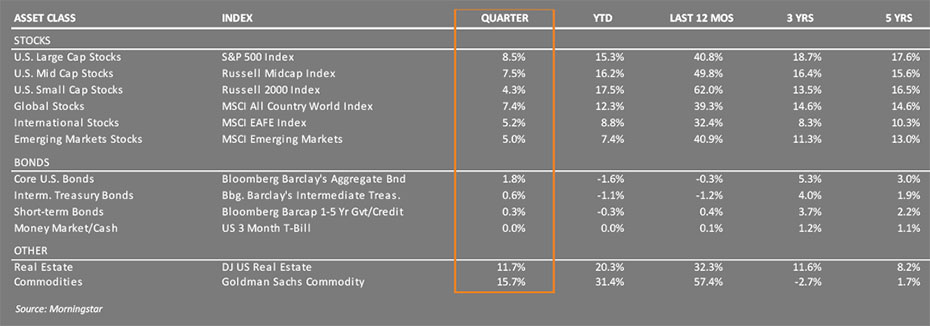

In the U.S., the S&P 500 index of large company stocks was nearly flat, up only 0.6% for the quarter. Small company stocks, which had outperformed for most of the year, were down 4.4% in the third quarter. International stocks were down 0.4%, with much of that coming from emerging markets which were off 8.1% during the quarter. Bonds provided little assistance as investors focused on a significant spike in inflation and the 10-year treasury yield rose from 1.45% on June 30 to 1.52% on September 30. The Bloomberg US Aggregate bond index, a proxy for the entire bond market, rose just 0.1% for the quarter. Real estate was one of the better performing sectors of the market (up 0.9%) with commodities outperforming everything as energy prices rose across the board.

Economy

It’s safe to say that Americans are done with COVID (whether or not the pandemic is actually over). JP Morgan estimates that between infections and vaccinations, roughly 80-90% of Americans have achieved some form of protection from the disease, making it easier for people to get back to normal. This has contributed to an increase in spending on goods and services over the past few months.

ACCREDITATIONS & AWARDS

We’re proud to have been honored by some of the organizations in our industry.

Gross Domestic Product (GDP) growth slowed in the third quarter due in large part to the Delta variant but should accelerate in the fourth quarter and into next year. Since the pandemic began, Congress has allocated more than $5.1 trillion in three different relief and stimulus spending packages, most of which has been spent already. Even if President Biden’s $3.5 trillion spending plan does pass (or is reduced down to something less), it will be spread over the next 10 years, so there will be much less support for the economy heading into 2022. Since 2001, GDP growth has averaged about 2%, and we do expect to see the economy settle back to that long-run trend.

As growth slowed during the quarter, so did job gains. Still, unemployment fell to 4.8% in September, and wage growth has been the strongest since the 1980s as employers are having to raise wages to entice workers back into the labor force. There were roughly 10.4 million job openings and only about 7.7 million unemployed workers.

As the pandemic recedes, inflation will likely become the primary concern facing investors. The question is whether higher inflation is the new normal or settles back below 2% as we’ve seen for the past decade. Higher wages may contribute to higher inflation even as companies work through shortages and supply chain bottlenecks. Markets have priced in about 2.5% inflation: an increase from years past but hardly disruptive for investors or the economy.

The main impact of higher inflation would be on interest rates. Inflation is the most important factor influencing market interest rates, so higher inflation suggests that interest rates could remain higher in the future. It is our view that inflation may run between 2-3% next year resulting in a modest rise in interest rates over several months or quarters.

The Federal Reserve has made it clear that they plan to begin tapering their bond purchases. When the Fed buys bonds, it helps to keep interest rates low, so reducing their purchases should allow interest rates to rise. In addition, they expect to raise overnight interest rates (currently near 0%) next year.

Higher interest rates could affect the valuation of stocks and future company earnings. Higher borrowing costs and higher wages can eat into corporate profits, currently at record highs. Higher interest rates also lower the value today of earnings received in the future, meaning that stock P/E ratios may start to deflate. This could keep a lid on stock market gains in the coming months.

GUIDES

The Essential Guide to Retirement Planning

A 4-part series that answers key questions about building your plan, positioning your investments, and more.

Overseas, most developed countries have outpaced the U.S. in terms of vaccinations and dealing with COVID. As the Delta variant recedes, developed economies are poised to recover quickly and should contribute to global growth. Increased consumption may exacerbate supply shortages as foreign consumers resume their own spending, offset by additional production in export powerhouses like Germany and Japan.

Outlook

Strong economic growth, continued fiscal and monetary stimulus, record earnings and improving optimism set the stage for the stock market to continue higher during the fourth quarter, although some volatility is expected. High valuations make the market more susceptible to negative surprises, so we would not be surprised by some volatility and maybe a correction at some point. But the conditions remain for continued gains both in the U.S. and abroad.

International stocks tend to be more sensitive to the kind of broad-based economic growth we expect in the coming months. When combined with more attractive valuations than U.S. stocks, they remain an attractive asset class, despite the pandemic related challenges in some countries. Stronger growth overseas and the rising U.S. trade deficit should put downward pressure on the dollar, enhancing returns to international investments.

The greatest risk to our positive outlook is a resurgence of the pandemic. New strains are constantly evolving, and a renewed outbreak cannot be ruled out, especially as vaccination rates slow and people become more complacent.

Our Team

As a client of Blankinship & Foster, you have a dedicated team of financial advisors, service and support professionals.

Our Portfolios

Our stock exposure is currently broad based and weighted towards large U.S. companies, which have proven remarkably resilient so far. Our fixed income positions continue to provide stability and diversification, if less than exciting income in this period of low yields. Fixed income investors should not expect much from the bond market as gradually rising interest rates mean minimal total returns in coming months. Even so, bonds remain attractive shock absorbers when stock market volatility arises, and thus are still an appropriate and meaningful part of a diversified portfolio.

If you have any questions about your investments or your financial plan, we would love the opportunity to discuss them with you.

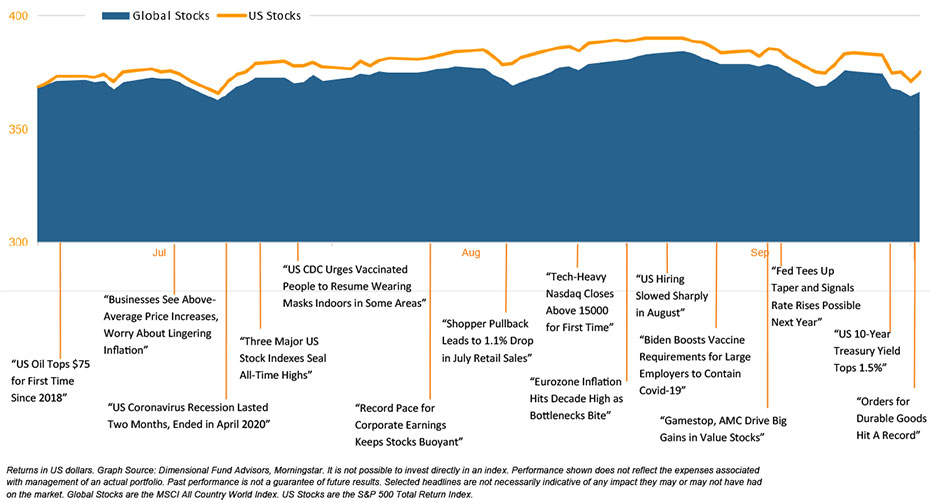

Global Stock Market Performance

The chart below shows the change in global equity markets throughout the year. Juxtaposed over the market performance are some of the key events that occurred during the period. Sometimes as we get to the end of a volatile period, it’s difficult to look back and remember everything that happened along the way.