It takes a lot of planning to design a successful retirement strategy. Saving and investing enough to fund a comfortable retirement is critical, but there are other things to consider as well. Your lifestyle, where you’ll live, medical expenses, pension, and Social Security are all pieces of the retirement puzzle.

One aspect of retirement planning that often gets overlooked is tax planning. Taxes can have a real effect on your retirement, and not planning for them can cause big surprises. Here are some common tax surprises that retirees come across, and what you can do to avoid them.

Retirement plan distributions

If you have diligently added to your savings and investments over the years, congratulations! One of the best ways to maximize savings is to designate a portion of your pay to automatically go into 401(k)s, IRAs, or other retirement plans. If that deferred pay goes to a “pre-tax” (not a Roth) plan, then taxes on the pay will be deferred. This lowers your tax bill in the working years and helps create room in your budget for higher savings.

However, this can also be one of the biggest tax surprises for retirees, since the tax is due when you withdraw money from the accounts. If those “pre-tax” retirement accounts are your main source of income early in retirement, you may find yourself in a high tax bracket. This can get really painful if your only way to pay the taxes on the distributions is by taking even more distributions from them. Clearly, knowing what you will pay taxes on in retirement is a key part of a successful retirement plan.

GUIDES

The Essential Guide to Retirement Planning

A 4-part series that answers key questions about building your plan, positioning your investments, and more.

Capital gains

Investments held in non-retirement plan accounts enjoy beneficial tax treatment in the form of lower tax rates. Qualified dividends and long-term (more than one year) capital gains are taxed at a 15-20% tax rate — or even 0%, depending on your income. Building up savings in non-retirement accounts can provide a real benefit in retirement. You can withdraw money from these accounts with less tax cost. However, the capital gains that build up in long-term investments are taxable when they are realized (sold). Those can really add up if enough are sold during the year. Combined with other sources of income, you can end up with higher tax rates on those gains, reducing the tax advantage.

Social Security

Social security benefits in retirement may be partially taxable, mostly taxable, or not taxable at all. It depends on your “combined income” for the year. For a couple filing taxes jointly, none of your and your spouse’s benefits are taxable if your combined income is less than $32,000. 50% of the benefits are taxable if income is between $32,000 and $44,000, and 85% of the benefits are taxable if income is more than $44,000. As you can see, an increase of just a few thousand dollars in income can cause an unexpected increase in your taxes in retirement.

Medicare premium surcharges

Medicare is the primary health insurance for millions of retirees aged 65 and over. Original Medicare (parts A and B) covers most hospital and medical costs. Other parts of Medicare (Part C, Part D, and Medigap) are private insurance plans can provide additional coverage. Part A has no premium, but all the other parts involve a premium.

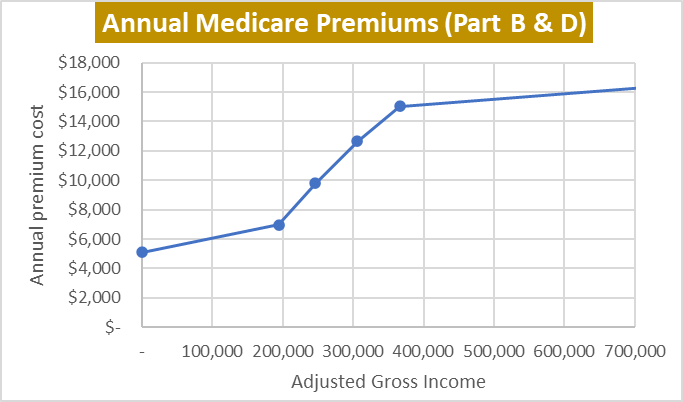

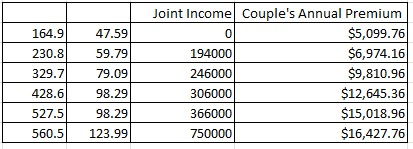

The basic Part B premium is $164.90 per month for 2023. However, added premium surcharges called income-related monthly adjustment amounts (IRMAA) can more than double your Part B and part D premiums. IRMAA surcharges are based on your total income, so while they are not technically a tax, they act like a tax. For instance, a couple filing a joint tax return with income under $194,000 will typically have Part B and Part D premiums of about $5,000 for the year. However, if their income is over $194,000, IRMAA surcharges can raise their total premiums to over $16,000 a year.

How to reduce the surprise factor

Having less tax surprises in retirement means planning your retirement in advance. This means planning for which accounts to draw from, and which pension, social security, and Medicare options to choose. It also means being careful about tax-generating activities like retirement plan distributions and capital gains. This often requires a deeper look at all the areas of your finances to make interconnected financial decisions.

At Blankinship & Foster, we specialize in building an integrated plan focused on the financial and life outcomes you really want. We consider all the important pieces of the retirement puzzle, including taxes.

Your Overall Strategy

Creating a strategy to optimize social security benefits is one part of the overall financial planning we help our clients do. As fiduciary financial advisors in San Diego, our job is to make sure our clients meet their retirement goals, despite all the uncertainties they face. With factors like taxes on social security to consider, contact us today to discuss how we can help you develop a multi-year plan that aligns with your goals.

Disclosure: The opinions expressed within this blog post are as of the date of publication and are provided for informational purposes only. Content will not be updated after publication and should not be considered current after the publication date. All opinions are subject to change without notice, and due to changes in the market or economic conditions may not necessarily come to pass. Nothing contained herein should be construed as a comprehensive statement of the matters discussed, considered investment, financial, legal, or tax advice, or a recommendation to buy or sell any securities, and no investment decision should be made based solely on any information provided herein. Links to third party content are included for convenience only, we do not endorse, sponsor, or recommend any of the third parties or their websites and do not guarantee the adequacy of information contained within their websites.