Despite a challenging first quarter and some decidedly mixed headlines during the second quarter, things have been looking up for investors. Stock markets looked to improving economic indications for guidance and shrugged off geopolitical concerns. Larger-cap U.S. stocks were up 5.2% for the quarter and 7.1% for the year to date. Smaller-company stocks have lagged so far this year, gaining just 2.1% during the quarter for a total of 3.2% for the year.

Developed international stocks also trailed U.S. stocks but still rose 4.1% for the quarter as the European Central Bank took additional steps to combat deflationary pressures. Meanwhile, Japan’s Prime Minister Shinzō Abe continued his multi-pronged effort to generate healthy inflation and boost Japan’s economy.

After a poor first quarter, emerging-markets stocks rallied, gaining 6.6% for the quarter and are now up more than 6% for the year. Among larger emerging markets, India’s newly elected prime minister was viewed favorably by investors, and the country’s stock market staged a huge second quarter rally. China’s economy continues to face risks stemming from its huge run-up in debt following the 2008 financial crisis.

Core U.S. bonds shared in the quarter’s gains as Treasury prices rose and bond yields continued to fall—a surprise to many investors—with the 10-year Treasury yield ending the quarter at 2.53%, down from 3.04% at the end of 2013. Meanwhile, the Federal Reserve remained consistent in its message: it will continue to gradually scale back its monthly bond purchases. The Fed has also indicated that it feels no urgency to raise interest rates based on what it sees currently on the jobs and inflation fronts.

The Economy

Investors have had to deal with a steady stream of mixed messages during the second quarter. In economic news, we received confirmation that very harsh winter weather caused the largest drop in economic activity since 2009. U.S. Gross Domestic Product (GDP)—a measure of all of the goods and services produced in the country’s economy—actually shrank during the first quarter.

The consensus expectation is for a solid rebound during the second and third quarters. Production metrics, retail and auto sales, and labor market measurements all rebounded strongly in recent months, though some pockets of weakness remain. For example, hours worked and total employment are up, but wage growth is still very sluggish. Despite recent strength, this remains the weakest economic recovery in the post-war period.

Global central banks and monetary policy continue to be complicating factors affecting financial markets, and geopolitical conflicts (in Ukraine and Iraq most prominently) have added additional dimensions of uncertainty. Overall, our big picture view and assessment of the risks and returns across the major asset classes have not changed meaningfully since last quarter. We continue to see the U.S. and global economies on a slow path of recovery.

We are becoming more attuned to inflation risk here in the U.S., given recent upticks we have seen in the inflation measures over the past months. In addition, we would expect that continued improvement in the labor market should start putting upward pressure on wages, though we haven’t seen evidence of this pressure yet.

The Markets

One thing that stands out for us about the past three months amidst the record-setting highs of the S&P 500 is the remarkably low stock market volatility. Low volatility and high stock prices reflect the market’s apparent lack of concern about risk, but they also suggest the market could be susceptible to negative surprises. So far, investors have managed to ignore flare-ups in Ukraine, Iraq and Gaza. Valuations of some assets (U.S. stocks in particular) appear elevated, and investors seem to be overly dependent on easy monetary policies and low inflation.

While we believe inflation risk may have increased at the margin, our portfolios’ bond allocations are already positioned for the likelihood of rising interest rates, which is the prime investor concern related to increased inflation. Moreover, the inflation pressures that have been observed are not significant enough relative to other potential macro scenarios we consider.

Our Portfolios

A meaningful portion of our fixed-income exposure is in funds that have significant flexibility to manage their inflation and interest-rate risk as compared to core investment-grade bond funds. Core bond funds would likely do better in a deflationary environment or market correction but would be expected to underperform as interest rates rise.

Within our overall global equities exposure, we are underweight U.S. stocks because our low single-digit base case return expectation for U.S. stocks is not enough to fully compensate us for their risk. We are also underweight smaller cap stocks and have maintained a position in a defensive sector fund. Meanwhile, we are roughly fully allocated to developed international and emerging-markets stocks, where our expected returns are higher, largely due to lower current valuations.

As we look forward and consider potential outcomes, ranging from optimistic to pessimistic, we are comfortable with the risk and return trade-offs we are making. While stock markets may be overvalued in the near-term, it is impossible to predict how long this condition might persist or how far things might go when a correction does occur. Our portfolios reflect our risk-management priorities but have also been able to participate broadly in the market’s gains. In the current low-volatility, low-yield, high-stock-price environment, we don’t see any asset classes offering compelling returns relative to their risk, and this remains a period in which patience and discipline are particularly critical.

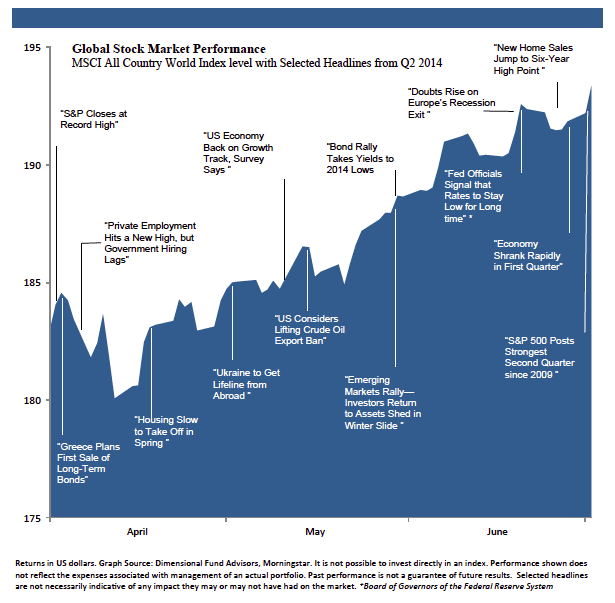

This chart shows the change in global equity markets throughout the quarter. Juxtaposed over the market performance are some of the key events that occurred during the quarter. Sometimes as we get to the end of a volatile period, it’s difficult to look back and remember everything that happened along the way.†

Download this Second Quarter 2014 Investment Review report as a PDF (162kb). Visit our archives for reports on past quarters.

As always, we appreciate your confidence and welcome questions about your individual situation.

†Returns in US dollars. Graph Source: Dimensional Fund Advisors, Morningstar. It is not possible to invest directly in an index. Performance shown does not reflect the expenses associated with management of an actual portfolio. Past performance is not a guarantee of future results. Selected headlines are not necessarily indicative of any impact they may or may not have had on the market. *Board of Governors of the Federal Reserve System.