Quarter In Review

If we’ve learned nothing in the past nine months, it’s that fiscal stimulus (cutting taxes and increasing government spending) is a very effective driver of economic activity. The government’s first estimate of Gross Domestic Product (GDP) growth for the second quarter was 4.2%, and the Wall Street Journal’s monthly survey of economists has third quarter growth running at about 3.2%

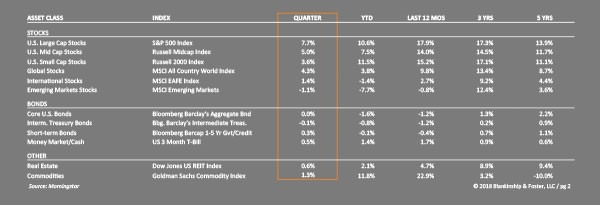

U.S. investors have largely shrugged off concerns of trade wars and geopolitical volatility with the S&P 500 rising 7.7%. Small company stocks underperformed larger companies, growing 3.6% during the quarter. Overseas investments have been weak for most of the year as strong U.S. growth propelled U.S. stocks. Stocks of companies in developed economies (Europe, Japan, etc.) rose just 1.3% in the third quarter. Emerging markets stocks continued to slide during the quarter, shedding 1.1% due to a combination of trade war blustering, U.S. tariffs and a rising dollar.

As U.S. stocks rallied, bonds were basically flat. The 10-year Treasury interest rate rose 0.2% (from 2.85% to 3.05%) during the quarter. Treasury prices fell as a result (prices move in the opposite direction of interest rates) during the quarter, offsetting the income earned. During the same period, 1-month Treasury interest rates rose 0.35%, further flattening the treasury yield curve (see our related blog post at www.bfadvisors.com on this topic). Lower quality corporate (“junk” or “high yield”) bonds solidly outperformed Treasuries, earning 2.4% during the quarter.

Other diversifying investments like Master Limited Partnerships (“MLPs”, up 6.6%) and real estate (up 0.7%) were positive but did not keep up with the U.S. stock market.

Outlook

As we head into the final stretch of 2018, we remain optimistic about the economy and the markets, at least in the near-term. The current economic expansion is the second longest since the Civil War and may end up being the longest in U.S. history. Consumer spending is very strong, unemployment is at 3.9% and average hourly wages jumped 2.9% in the last year, the highest gain since 2009. That said, wage growth has averaged 4.1% since 1969, so the “average” worker may not have felt the full benefits of expansion.

Inflation remains relatively mild, though the headline Consumer Price Index recently posted a 2.7% year-over-year growth, boosted by rising energy prices. If the trade spat with China continues, some estimates suggest that additional tariffs could add an extra half percent or so to inflation, but so far the administration has gone out of its way to avoid imposing tariffs on consumer goods.

FAQS

We’re happy to answer any questions you have about our firm and our processes. Here are answers to some of the questions we receive most frequently.

One cautionary sign is related to a lack of workers. The Bureau of Labor Statistics (“BLS”) estimated that roughly 6.9 million jobs were unfilled at the end of July, compared to 6.28 million available unemployed workers. This should put upward pressure on wages, either reducing corporate profits or putting additional upward pressure on inflation. A limited pool of labor can also restrict company growth and operations. For example, a client recently told us they’ve had to delay a planned construction project because their contractor simply could not find workers to man the project.

All-in-all, measures of economic activity remain sound and point to continued growth ahead, though the current stimulus fueled pace is unlikely to continue. Consensus is building that last year’s tax cuts have provided a solid boost to growth, but the effects are likely to dwindle back to 2-2.5% over the next few quarters.

Internationally, the rising dollar has put pressure on emerging markets economies. U.S. economic strength, fueled by the stimulus, seems to have drawn investors into U.S. capital markets. As the effects of the stimulus fades, the U.S. economic out-performance should moderate, and other markets should look better by comparison. While weaker than the current U.S. economy, growth in Europe and Japan appears to be steady and sustainable, backed by more attractive valuations.

Meanwhile, the strong dollar has put pressure on some of the weaker emerging markets economies. If moderating U.S. growth causes the dollar to soften, this could relieve the pressure. In addition, should trade tensions prove to be overblown, there is a potential catalyst for out-performance in emerging markets stocks. Of course, the downside risk is that trade tensions increase, throwing global supply chains into turmoil. This doesn’t appear to be priced into markets.

ARTICLE

Invest $100K the Right Way

At some point, you may find yourself with $100,000 in the bank and questions on how to invest it.

Our Portfolios

Although we feel a recession in the coming years may be likely, it’s nearly impossible to determine when that might occur or how far in advance markets could sell-off once it does happen. Other alternative outcomes are also possible, including additional debt-fueled fiscal stimulus to head off an economic decline. For now, the Treasury yield curve is modestly upward sloping (longer-dated maturities yield more than shorter maturities) signaling continued expansion.

One thing that has not worked particularly well over the past few months has been diversification. Investors have bid up the price of U.S. equities, particularly large company stocks, virtually to the exclusion of all else. This happens occasionally, and it never lasts.

Our exposure to diversifying investments (international stocks, investment grade bonds, etc.) delivered mixed results. Our bond positions broadly outperformed the bond market during the quarter’s turbulence due to strong results from our income diversifiers. Our investments in faster growing companies (“growth stocks”) performed well, as would be expected late in the economic cycle. International investments lagged U.S. stocks, as did MLPs.

We continue to believe that our portfolios are well positioned to generate returns late in the economic cycle. More importantly, they should be able to withstand the ups and downs of a more volatile stock market and bond markets as we head into the unpredictable mid-term elections.

Fiduciary

We are fiduciaries, and it’s not just a word. It’s a binding commitment to put your interests first.

As always, we appreciate your confidence and welcome questions.

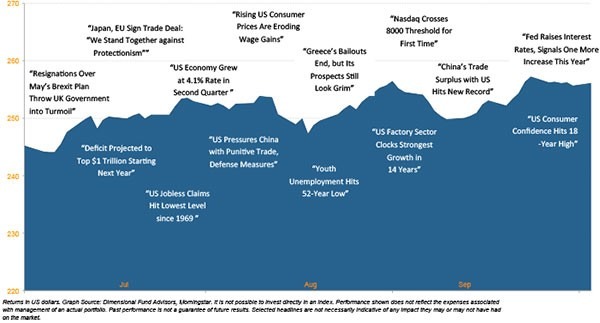

Global Stock Market Performance

The chart below shows the change in global equity markets throughout the year. Juxtaposed over the market performance are some of the key events that occurred during the period. Sometimes as we get to the end of a volatile period, it’s difficult to look back and remember everything that happened along the way.

Download this Second Quarter 2018 Investment Review as a PDF

View reports on past quarters here.

Past performance is not an indication of future returns. Information and opinions provided herein reflect the views of the author as of the publication date of this article. Such views and opinions are subject to change at any point and without notice. Some of the information provided herein was obtained from third-party sources believed to be reliable but such information is not guaranteed to be accurate.

The content is being provided for informational purposes only, and nothing within is, or is intended to constitute, investment, tax, or legal advice or a recommendation to buy or sell any types of securities or investments. The author has not considered the investment objectives, financial situation, or particular needs of any individual investor. Any forward-looking statements or forecasts are based on assumptions only, and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. Any assumptions and projections displayed are estimates, hypothetical in nature, and meant to serve solely as a guideline. No investment decision should be made based solely on any information provided herein.

There is a risk of loss from an investment in securities, including the risk of total loss of principal, which an investor will need to be prepared to bear. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular investor’s financial situation or risk tolerance.

Blankinship & Foster is an investment adviser registered with the Securities & Exchange Commission (SEC). However, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Complete information about our services and fees is contained in our Form ADV Part 2A (Disclosure Brochure), a copy of which can be obtained at www.adviserinfo.sec.gov or by calling us at (858) 755-5166, or by visiting our website at www.bfadvisors.com.