Quarter in Review

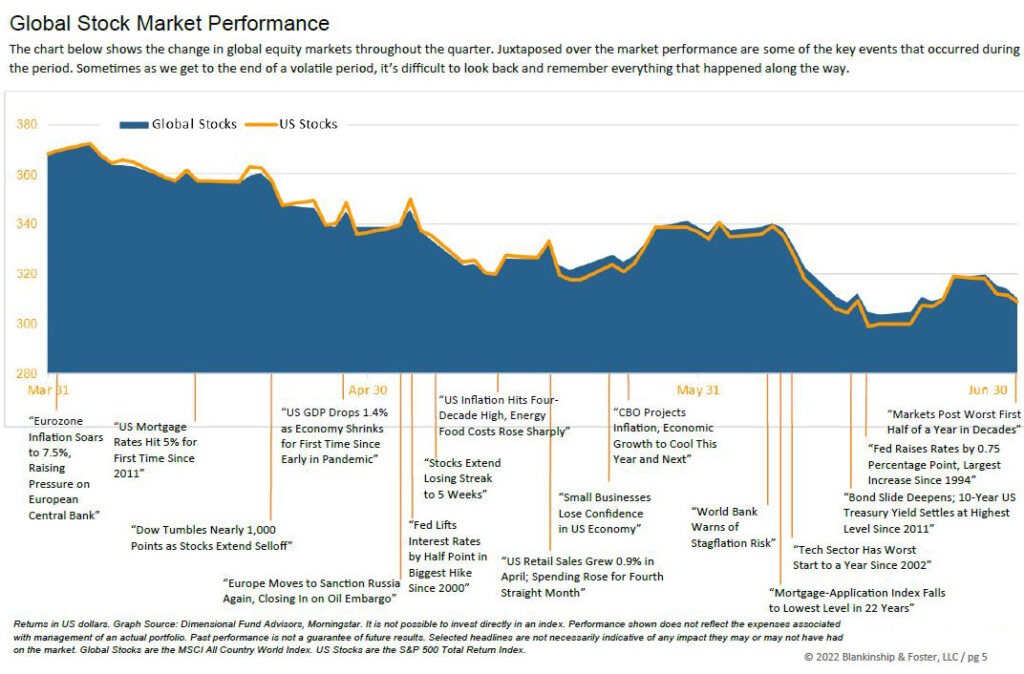

Global capital markets continued to struggle during the second quarter of 2022. Multiple factors continued to drive high inflation including excess stimulus from prior years, a relaxation of COVID restrictions (and personal restraint) across developed markets at the same time COVID outbreaks forced Chinese policy makers to impose stark lockdowns, all compounded by the continuing conflict in Ukraine and its impact on global food and energy supplies. In short, demand for goods and services has surged while supply chains struggle to recover.

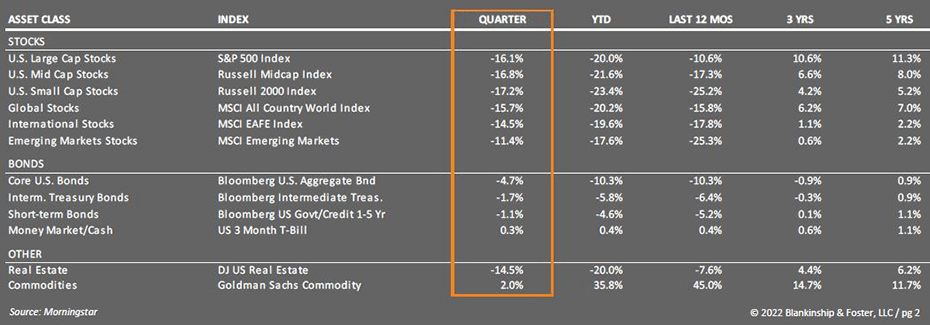

In the United States, rising interest rates, high inflation and sagging investor confidence led to continued declines across the board during the quarter. The S&P 500 index of large U.S. companies fell 16.1% for the quarter, down 20% year-to-date. Smaller companies lost 17.2% in the quarter and stocks of companies in developed non-U.S. countries dropped 14.5% in dollar terms (only 7.8% in local currency terms).

The bond market continued to struggle as interest rates rose again during the quarter. The 10-year Treasury yield rose from 2.32% to 3.48% before ending the quarter at 2.98%. As a result, bonds posted losses for a second quarter in a row (bond values fall when interest rates rise). The Bloomberg U.S. Aggregate index lost 4.7% in the quarter and is down 10.4% year-to-date. High yield “junk” bonds fell 9.8% in the quarter. The only assets to post gains were commodities, up 2.0% in the quarter and up 35.8% year-to-date, in part due to the surge in energy and food prices following Russia’s invasion of Ukraine.

Fiduciary

We are fiduciaries, and it’s not just a word. It’s a binding commitment to put your interests first.

Economy

Policy makers are scrambling to catch up to high inflation, though in large part they’re to blame for the current situation. In a nutshell, it’s now clear that the Federal government (under both recent administrations) overreacted to the shock of the pandemic on the economy with far too much fiscal stimulus while the Federal Reserve kept interest rates too low for too long (monetary stimulus). This resulted in a lot of people with a lot of money to spend, but also pushed the debt-to-GDP ratio above 100%, a level which typically results in reduced economic growth in the future.

At the same time, the COVID crisis disrupted supply chains, limiting the availability of goods to purchase. Russia’s invasion of Ukraine exacerbated the supply problems in multiple categories from food to fuel to rare minerals (microchips). The excess stimulus in the economy fueled a quick, strong recovery from the pandemic, resulting in a very tight labor market. Right now, there are about two job openings for every unemployed worker. This was made worse by the early retirement of many workers (like airline pilots), putting further upward pressure on wages.

The Federal Reserve has finally reacted by raising interest rates three times already this year to bring inflation under control, with more rate hikes expected in the coming months. Rising interest rates in the U.S. have led to a very strong dollar, though as other central banks catch up, this will ease somewhat. For now, Congress has put the brakes on further fiscal stimulus. Rising interest rates, high federal debt, fiscal restraint and a strong dollar will all act to slow economic growth going forward, thus also crimping corporate profits.

This is the cocktail of pressures that has driven investor sentiment (and with it stock prices) down so far this year, but this is also pretty much priced into capital markets. The question then is whether conditions are better or worse than expected. That is what will drive investor returns going forward.

Outlook

Recession risks have clearly risen in recent months, but consensus forecasts point to slower growth for the rest of the year and for inflation to moderate to around 3% in 2023 while the unemployment rate remains steady around 3.6%. The current expansion still seems to have momentum, driven by high household savings, low debt levels and some continued fiscal stimulus (allocated congressional funds that haven’t been spent yet). High interest rates have not yet really begun to crimp demand and current indicators are still positive, though softening at the margins. Finally, investor sentiment is currently around the lowest levels, meaning that investors are very concerned about the current conditions. But investor sentiment is a contrarian indicator, suggesting that a good time to add to your risk holdings is when investors feel their worst about the market.

Forecasters are split on whether a recession has begun, is imminent, or may yet be avoided entirely. If a recession has already begun, it would be a very strange one indeed with employment continuing to be very strong and most activity indicators far from recessionary territory. As we move back towards trend sustainable growth (around 2.5% annual GDP growth), the question is whether we’ll be able to settle back down to ‘normal’ or overshoot into recession.

With the increased possibility of a recession sometime in the next 12-18 months, we remain cautiously optimistic about prospects for capital markets. For one thing, the average recession since 1945 has been relatively brief (less than 12 months) and shallow. And capital markets have already sold off quite a bit in expectation of that contraction.

The base case for a recession assumes the Federal Reserve aggressively and successfully attacks inflation as they’ve promised to do, so commodities and other inflation sensitive investments should underperform if that’s the case. With investor sentiment so low, we cannot rule out a near-term recovery in stock prices. Stagflation would tend to favor Treasury Inflation Protected Securities (TIPS) over economically sensitive assets like commodities, but rising interest rates have partially offset the normal benefits they would provide in a portfolio.

FAQS

We’re happy to answer any questions you have about our firm and our processes. Here are answers to some of the questions we receive most frequently.

Our Portfolios

So far, 2022 has been one for the history books: an extraordinary period where stocks and bonds fell in unison and almost every asset class was hard hit, with the exception of cash and commodities. In short, there was almost no place to hide from the volatility. Despite that, our portfolios held up relatively well compared to their benchmarks.

Valuations for both U.S. and international stocks have improved significantly over the past few months. Our stock exposure is currently broad based and weighted towards large U.S. companies. Our international exposure benefited from our blend of currency hedged investments, which outperformed as the dollar strengthened during the quarter.

Over the long haul, stocks tend to hold up well as inflation rises. If we see additional evidence that the actions of the Federal Reserve are ineffective in lowering inflation, we may consider adding some direct inflation hedges to our portfolios.

Fixed income (bonds) as an asset class has struggled as interest rates rose faster than expected. Our shorter dated bonds helped to offset the worst impacts of rising interest rates. However, the higher interest rates also mean that expected bond returns going forward are significantly better than they were this time last year. Even so, bonds remain important shock absorbers when stock market volatility rises, and thus are still an appropriate and meaningful part of a diversified portfolio. Our inflation protection comes mainly from equity exposure, though we are exploring other options to improve on this.

If you have any questions about your investments or your financial plan, we are here for you and are ready to provide the guidance and planning you expect from us. We would love the opportunity to discuss them with you.

Going Green

We are excited to announce that, through working with our technology vendors, we are able to help save paper by delivering your quarterly reports to you via our secure online portal. And accessing the reports through a secure internet connection is actually more secure.

If you would like to help us save a few trees (and make the reports available whenever you are ready to read them), then please email your advisor and ask about converting your reports to electronic delivery.

DISCLOSURE:

Past performance is not an indication of future returns. Information and opinions provided herein reflect the views of the author as of the publication date of this article. Such views and opinions are subject to change at any point and without notice. Some of the information provided herein was obtained from third-party sources believed to be reliable but such information is not guaranteed to be accurate.

The content is being provided for informational purposes only, and nothing within is, or is intended to constitute, investment, tax, or legal advice or a recommendation to buy or sell any types of securities or investments. The author has not considered the investment objectives, financial situation, or particular needs of any individual investor. Any forward-looking statements or forecasts are based on assumptions only, and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. Any assumptions and projections displayed are estimates, hypothetical in nature, and meant to serve solely as a guideline. No investment decision should be made based solely on any information provided herein.

There is a risk of loss from an investment in securities, including the risk of total loss of principal, which an investor will need to be prepared to bear. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular investor’s financial situation or risk tolerance.

Blankinship & Foster is an investment adviser registered with the Securities & Exchange Commission (SEC). However, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Complete information about our services and fees is contained in our Form ADV Part 2A (Disclosure Brochure), a copy of which can be obtained at www.adviserinfo.sec.gov or by calling us at (858) 755-5166, or by visiting our website at www.bfadvisors.com.