Quarter In Review

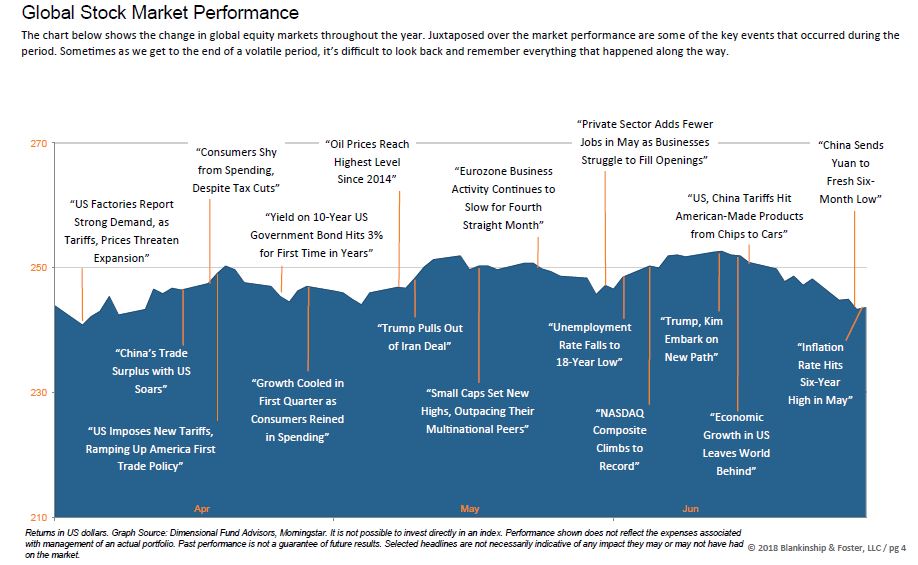

Markets rebounded somewhat from the 10% correction during the first quarter but gains have come in fits and starts during the second quarter of 2018. Investor angst over trade has grown as tit-for-tat tariff threats have roiled capital markets. A successful Korean summit in Singapore, which somewhat eased concerns of war on the peninsula, has been offset by the announcement of trade tariffs against long-time allies (Canada, Mexico, and the European Union) and adversaries (China) alike. Investor emotions have been whipsawed during the quarter, even as corporate profits continue to grow as a result of the large corporate tax cut passed last December.

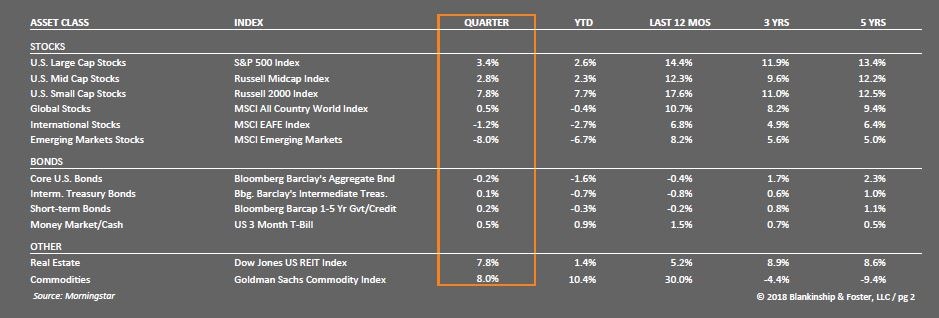

The S&P 500 was up 3.4% during the second quarter, bringing large company stocks back above the break-even mark for the year. Smaller U.S. companies tend to be less exposed to oversees operations and are thus less affected by the concerns of global multi-nationals. At the same time, they also tend to benefit from strong domestic growth and are up 7.8% for the quarter.

International stocks have had a tougher time as a strengthening dollar has eaten away at returns for U.S. investors in overseas companies. Stocks of companies in developed countries are down about -1.2% for the quarter and -2.7% year-to-date. Trade fears and a rising dollar have had an even bigger impact on emerging markets stocks, off -8.0% for the quarter and -6.7% for the year. Currency hedges were once again helpful in offsetting the rising dollar.

The stock market volatility has been accompanied by choppy fixed income markets as well. The Federal Reserve has raised short-term interest rates twice so far this year and has indicated a bias toward two more in the second half of the year. The good news is that money markets (and some bank accounts) are earning higher income. The bad news is that intermediate and longer-term bonds have suffered. The 10-year Treasury has risen from 2.46% in January to 2.85% at the end of the quarter. As a result of rising interest rates, intermediate bonds are off about -1.6% year-to-date.

GUIDES

The Essential Guide to Retirement Planning

A 4-part series that answers key questions about building your plan, positioning your investments, and more.

Commodities have been the clear winner for the past 12 months, driven by a steady rise in the price of oil and the strength of the U.S. dollar. Accelerating growth and low interest rates have also benefitted REITs, up almost 8% for the quarter. Master Limited Partnerships (MLPs) also had strong gains during the quarter, up 11.8%.

Outlook

As we head into the second half of 2018, we remain optimistic about the economy and the markets, at least in the near-term. As the U.S. economy enters it’s tenth year of expansion (the recession officially ended in June of 2009), measures of economic activity remain sound and point to stronger growth. The stimulus provided by last year’s tax cuts continues to gain traction as employment, manufacturing and service sector statistics paint a picture of strong growth for the remainder of the year.

Despite the first quarter’s modest growth of 2.2%, Gross Domestic Product (GDP) is expected to accelerate to around 3% this year before slowing back to the recent trend of around 2% per year by 2020. In terms of economic fundamentals, there appear to be three main catalysts which could derail this story: interest rates, trade and employment.

Over the past three years, the Federal Reserve has raised its Fed Funds target rate from 0.25% to 1.75% – 2% today and is on record as expecting two more hikes (to 2.25%) this year. The primary reason the Federal Reserve (“Fed”) uses interest rates as a monetary policy tool is that higher interest rates act as a brake to slow down growth, which also cools inflation. With inflation gauges exceeding Fed targets, it seems clear they will continue to raise interest rates. It’s a difficult balancing act, and one of our main concerns is that the Fed has rarely managed to slow growth without also creating a recession in the process.

A second catalyst would be trade. Markets sold off in January largely over tariffs and the potential for significant damage to existing global trade relationships. Investors have become nervous about the potential for tariffs and retaliatory tariffs to spiral out of control into a full blown trade war, possibly on multiple fronts (China, NAFTA, EU). This would result in lost jobs and higher prices across many sectors, putting a damper on growth, investment and confidence. So far, the worst fears have not yet been realized, but that could change quickly.

A final concern is a lack of qualified workers. For the first time since economic records have been kept, reports in April showed more job openings than there were unemployed workers. If companies feel constrained by a lack of qualified candidates for new jobs (as has been widely reported), then they may delay plans for new projects which can also stifle growth. Current immigration policies designed to limit the flow of new workers could exacerbate this trend.

Globally, dollar strength has cut into investment prospects more than anticipated, but valuations overseas remain more attractive than in the U.S.

ACCREDITATIONS & AWARDS

We’re proud to have been honored by some of the organizations in our industry.

Our Portfolios

Although we feel a recession in the coming years may be likely, it’s nearly impossible to determine when that might occur or how far in advance markets could sell-off once it does happen. Other alternative outcomes are also possible, including additional debt-fueled fiscal stimulus to head off an economic decline.

As with last quarter, our portfolios held up fairly well given the choppy markets. Our exposure to diversifying investments (not core stocks or bonds) delivered mixed results. Our bond positions broadly outperformed the bond market during the quarter’s turbulence and our income diversifiers performed extremely well. Our investments in faster growing companies (“growth stocks”) performed well, as would be expected late in the economic cycle.

The low volatility that defined 2017 does seem to be a thing of the past, so our portfolios remain broadly diversified and positioned for rising interest rates as well as continued growth. We continue to believe that our portfolios are well positioned to generate returns late in the economic cycle, and to benefit from the current acceleration of growth in the economy. More importantly, they should be able to withstand the ups and downs of a more volatile stock market and bond markets.

As always, we appreciate your confidence and welcome questions.

Download this Second Quarter 2018 Investment Review as a PDF

View reports on past quarters here.

Past performance is not an indication of future returns. Information and opinions provided herein reflect the views of the author as of the publication date of this article. Such views and opinions are subject to change at any point and without notice. Some of the information provided herein was obtained from third-party sources believed to be reliable but such information is not guaranteed to be accurate.

The content is being provided for informational purposes only, and nothing within is, or is intended to constitute, investment, tax, or legal advice or a recommendation to buy or sell any types of securities or investments. The author has not considered the investment objectives, financial situation, or particular needs of any individual investor. Any forward-looking statements or forecasts are based on assumptions only, and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. Any assumptions and projections displayed are estimates, hypothetical in nature, and meant to serve solely as a guideline. No investment decision should be made based solely on any information provided herein.

There is a risk of loss from an investment in securities, including the risk of total loss of principal, which an investor will need to be prepared to bear. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular investor’s financial situation or risk tolerance.

Blankinship & Foster is an investment adviser registered with the Securities & Exchange Commission (SEC). However, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Complete information about our services and fees is contained in our Form ADV Part 2A (Disclosure Brochure), a copy of which can be obtained at www.adviserinfo.sec.gov or by calling us at (858) 755-5166, or by visiting our website at www.bfadvisors.com.