Quarter In Review

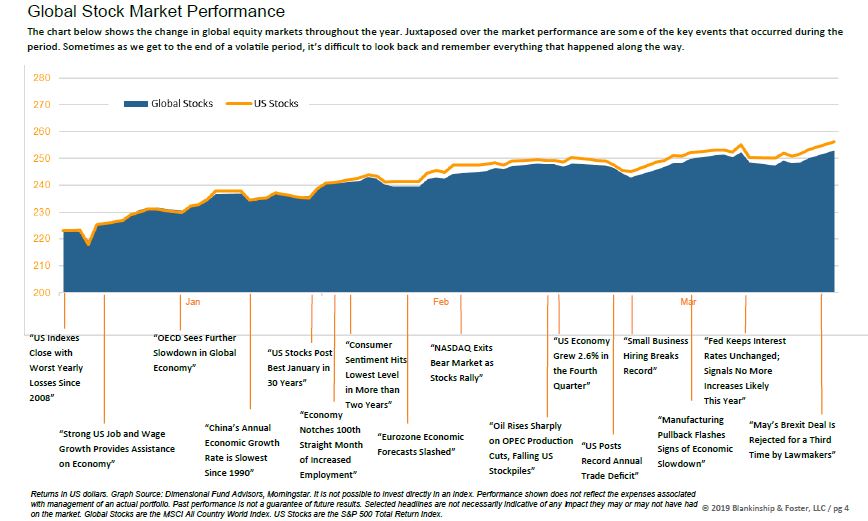

Following a challenging 2018, U.S. stocks came roaring back in 2019. Whatever concerns consumers and investors might have about political, geopolitical or economic instability, they do not seem to be reflected in stock prices, although the enthusiasm waned a bit towards the end of the quarter.

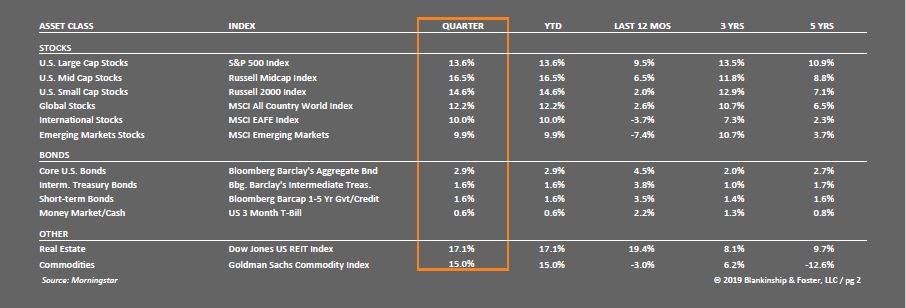

Global equity markets delivered double digit returns during the first quarter. Large U.S. company stocks rose 13.7% in the first quarter while stocks outside the U.S. gained 12.2%. Smaller U.S. companies, represented by the Russell 2000 Index, rose 14.6%. Diversifying investments like Real Estate Investment Trusts (“REITs”) and pipeline companies (“MLPs”) did even better, up 17.1% and 16.8%, respectively.

The U.S. fixed income market, represented by the Bloomberg Barclays US

Aggregate Bond Index, returned a respectable 2.9%. Bonds traded in a reasonably narrow range for most of the quarter. The ‘benchmark’ 10-year Treasury bond yield ranged from about 2.6% to 2.8% for most of the quarter before finishing near its low for the quarter at 2.4% as investors began to digest some disappointing economic news.

Outlook

The U.S. Treasury yield curve has remained relatively flat throughout the quarter, with 10-year yields falling below 1 year yields briefly in late March. As we discussed last quarter, this suggests the markets anticipate lower short-term interest rates in the near future, a potential sign of recession. The warning light is still on the dashboard, but again it’s flashing yellow, not bright red. Looking ahead, we see four main questions for the rest of the year.

Is US growth slowing or stalling?

Following the 2017 tax cuts, economic growth measured by Gross Domestic Product (GDP) clearly accelerated, albeit temporarily. As we stated last year, we expected there to be a bit of a short-term ‘sugar high’ and growth would settle back down to the preexisting trend. That is exactly what has happened, as growth for 2018 accelerated to about 3% and now seems to be settling back down to around 2%.

GUIDES

The Essential Guide to Retirement Planning

A 4-part series that answers key questions about building your plan, positioning your investments, and more.

The question is whether it goes lower from there, and that doesn’t seem to be in the cards at this time. The economic sectors that have overheated to cause past recessions aren’t currently overextended. The Federal Reserve, which has caused recessions in the past by raising interest rates too quickly, has actually been very slow and measured this time around. The economy seems poised to chug along at a relatively steady, if unexciting, 2% pace for the foreseeable future.

What is the next move for interest rates?

We do not see the Federal Reserve changing interest rates any time soon. Not only has the Federal Reserve (“Fed”) signaled it won’t be raising short-term rates again for a while, but they have also indicated they will stop selling bonds back into the market (unwinding the quantitative easing in which they purchased bonds from investors). The Fed’s growth forecast is currently very mild, and inflation is currently about 1.5% (below their 2% target). As a result, there is no need to continue raising interest rates in order to tamp down (non-existent) inflation. It’s possible the Fed could cut rates, but this would be problematic for two reasons. First, it would create the appearance of caving to political pressure, something they are loathe to do. Second, cutting interest rates would signal to investors that the Fed is more worried about growth and might actually trigger a sell-off.

Looking to longer-term interest rates, mild growth and a lack of inflation suggests longer-term interest rates aren’t likely to move much higher, either, so the 10-year Treasury should stay near or under 3%. This should also keep borrowing costs low for homeowners and extend gains in housing markets.

What will happen to international stocks?

The under-performance of non-U.S. stocks is largely a result of rising trade tensions and the impact that’s had on global trade. Most other countries export far more than the United States, so rising tensions and tariffs have had a disproportionate impact on economic activity outside the U.S. We are not immune, as slowing growth around the world can affect the U.S. This global “synching lower” of economic activity remains one of the significant risks going forward. That said, international stocks continue to be valued at a meaningful discount compared to U.S. stocks, and offer higher yields to boot. In addition, a resolution of the trade tensions should boost prospects and profits, further benefiting overseas investments.

ACCREDITATIONS & AWARDS

We’re proud to have been honored by some of the organizations in our industry.

What are the risks?

In a “Goldilocks” economy (not too hot, not too cold, but just right) like today, the greatest risk is a policy error that upsets the balance. The markets have largely priced in a resolution of the China trade imbroglio, but if that doesn’t come to pass (or takes too long to resolve), investors could become nervous. Similarly, increased trade tensions (like higher or additional tariffs on automobiles) with Europe could also increase volatility. Additionally, U.S. corporate earnings may not grow as fast as they have in recent years. Earnings ultimately drive stock prices and were boosted last year by the tax cut which has largely been priced into stock valuations. Additional earnings growth may be harder to achieve in a tight labor market where companies have to raise wages to attract workers, increasing their costs and impacting bottom line earnings growth. Still, even modest earnings growth should help boost share prices.

Finally, later this year, Congress will need to raise the debt ceiling. We can’t even begin to imagine how that will play out with the election around the corner, but it could get ugly. While investors seem to have become accustomed to such unnecessary drama, it does raise the probability of a material policy miscalculation and increased volatility as investors react.

Our Portfolios

In the current Goldilocks economy where everything is a little expensive, there are no clear “fat pitches” so it pays to be broadly diversified. Our portfolios are broadly diversified and positioned to benefit from increasing stock prices while providing downside protection. We are prepared for slower growth and the possibility of recession.

With global economic growth slowing and the U.S. economy expected to decelerate, investors should not expect the kind of gains we saw in 2017. This past quarter has been a bit of a snap-back from a steep sell-off, but it’s unlikely stocks climb significantly higher without additional fiscal stimulus.

We still view the current environment with cautious optimism, at least for this year. As always, if you have specific questions about your investments or your portfolio, we’d love the opportunity to discuss them with you.

Download this First Quarter 2019 Investment Review as a PDF

View all reports here, or visit our resources page.