Fourth Quarter 2024 in Review

According to Goldman Sachs, the U.S. economy likely grew at a 2.8% annual pace in 2024, above what many consider to be the long-term trend growth pace of around 2-2.5%. At the same time, inflation continues to decelerate on a path towards the Federal Reserve’s 2% target, though still coming in at a slightly elevated 2.7% pace for the year. Slowing inflation combined with a softening labor market allowed the Federal Reserve to begin cutting interest rates at its September meeting, but expectations for future rate cuts have been dampened by stronger economic performance and some stubbornly high inflation readings in recent months. The Atlanta Fed’s GDPNow estimate of growth for the fourth quarter was at 3.0% as we write this, so it seems possible the Fed has managed to achieve the mythical soft landing – slowing inflation without sending the economy into reverse.

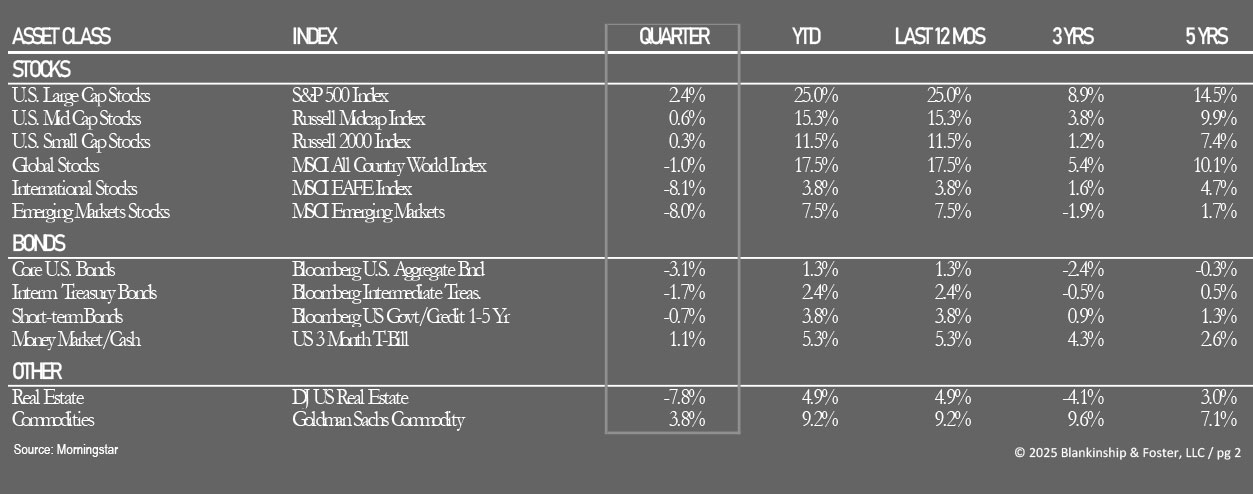

Economic growth, strong consumer spending and excitement over artificial intelligence (AI) were just some of the facts driving another year of strong U.S. stock market gains this year, though the fourth quarter did see some volatility. The S&P 500 Index of large U.S. companies rose 2.4% in the fourth quarter and is up a solid 25.0% for the year. That said, this performance was almost entirely driven by larger (and mostly technology) stocks. Smaller company stocks, represented by the Russell 2000 Index, were nearly flat in the fourth quarter and only up 11.5% for the year. International stocks, represented by the MSCI EAFE index shed 8.1% in the fourth quarter, largely on economic concerns in Europe and fears over higher tariffs with the incoming Trump administration. International stocks were only up 3.8% in 2024. The benchmark 10-year Treasury yield ended the year at 4.58%, significantly higher than the 3.63% bottom in September, again on concerns over tariffs and higher inflation and despite the Fed’s interest rate cuts. The Bloomberg US Aggregate Bond Index (representing the entire bond market) fell 3.1% during the fourth quarter as longer-term interest rates surged and was up only 1.3% for the year.

Alternative investments have been something of a mixed bag. High Yield “junk” bonds were basically flat during the quarter but gained 8.2% in 2024. Commodities rose 3.8% during the fourth quarter and were up 9.3% for the year. Commercial real estate, represented by the Dow Jones US Real Estate Index, fell 7.8% for the quarter as interest rates rose, ending the year with a modest gain of 4.9%.

Economy

As we’ve written, Gross Domestic Product (GDP) accelerated in the second half of the year. Goldman Sachs is estimating 2.7% GDP growth for 2024, somewhat above the long-term trend since 2000. Strong consumer spending and consumer confidence have contributed to the economic strength, though inflation leveled off a bit during the second half of the year. In addition, the labor market seems to have settled into a more normal range, with unemployment running just over 4%, above the recent low of 3.4% but well below the 50-year average of 6.2%. Wage growth has also settled down to about 3.9%, modestly outpacing inflation. Steady, above-trend economic performance should support continued job growth and keep a lid on unemployment rising further.

With stable unemployment, wage growth should also stabilize. One caveat to both of these forecasts is immigration policy. Legal immigration has helped stabilize the job market (filling many of the ten million or so job vacancies following the COVID pandemic, easing unemployment and helping keep wages in check. Removing a substantial number of workers from the economy could result in a hotter labor market and increasing wages as employers compete for fewer workers.

This is one of the concerns that’s driven bond market yields higher since September.

FAQS

We’re happy to answer any questions you have about our firm and our processes. Here are answers to some of the questions we receive most frequently.

Which brings us to our major theme for this year-end report. Heading into 2025 with a strong economy, analysts remain cautious about the year given the uncertainty of economic policy. It remains unclear just how much of the Trump administration’s campaign promises on tougher immigration enforcement, tougher global tariffs and generous tax cuts can or will be implemented, and how quickly. There’s strong consensus that if given all three, the U.S. economy would likely slow, and costs would rise. This is because wages would likely rise in a shrinking labor market, and domestic producers can charge higher prices when they don’t face foreign competition. These factors would be compounded by additional tax cuts which would provide additional disposable income for consumers and possibly higher interest rates as government borrowing increases to fund expenditures. It’s important to note that none of this suggests an immediate recession, but the uncertainty over the size of these policy shifts and their impact is the most likely culprit for the weakness in stock and bond markets in the fourth quarter.

Overseas conditions remain mixed, but structural tailwinds are encouraging. Japan has finally moved past its prolonged period of stagnation and should show signs of improved consumer spending and earnings growth. Increased competition with the U.S. and painful economic reforms make China’s outlook cloudy, but Taiwan has surged on strong growth in AI and the microchips needs for the computers to process it. Robust earnings and strong exports have driven robust growth in India while conditions are much less favorable in Germany and France. Uncertainty about tariffs bolstering the case for international investing is the fact that domestic stock valuations are approaching levels last seen during the tech bubble of the late ‘90s. By comparison, international stocks are much cheaper and despite some potential headwinds, their attractive valuations provide greater margins for error if investor sentiment turns against riskier investments.

Outlook

As we begin 2025, moderate GDP growth with relatively low inflation has produced something of a “Goldilocks” economy—where growth is not too fast to stoke inflation, but not too slow to signal a recession. The consensus of most analysts is that this should continue, but that policy changes by the incoming administration are likely to cause shifts in economic conditions. The challenge is that there is zero consensus about how quickly these changes can be implemented or the magnitude of those changes. For example, it’s not clear how quickly the administration will be able to impose new tariffs on imports, nor whether the proposed tariffs (10-20% across the board) were just bluster, negotiating positions or serious policy proposals. Similarly, changes to immigration policy and deportation of undocumented (and other) immigrants will likely take time to implement, so the impact on the labor force is difficult to predict in the short-term.

Looking ahead, corporate earnings are expected to continue growing for the foreseeable future. This is largely due to continued productivity gains, cost containment, and favorable demand conditions. In addition, a lighter regulatory touch by the incoming Trump administration has investors optimistic about corporate earnings in the coming year. One note of caution is U.S. equity market valuations. According to J.P. Morgan, the 10 largest stocks in the S&P 500 account for roughly 40% of the market value of the index. This concentration has been profitable, but it also means that any change in investor expectations will have a disproportionate impact on that index.

The optimistic scenario is that the current modest economic growth, supported by maintaining current tax rates (significant deficit spending by the Federal government), combined with gentler regulations could be good for U.S. corporations and for profits. The other side to this is that higher tariffs could increase the cost of producing goods while U.S. consumers are already fed up with higher prices, reducing corporations ability to pass higher costs on to customers. The supply chain disruptions of volatile trade policy and retaliatory tariffs could exacerbate this problem, reducing profit margins and thus possibly trimming stock prices. The wild card is the extent of the new tariffs and the speed with which they are imposed.

On the interest rate front, the Federal Reserve has slowed its shift to lower interest rates as inflation has leveled off above its 2% target. As discussed, bond investors have already pushed longer-term rates higher on expectations of increased government borrowing and higher inflation. If rates remain where they are, the higher yields on bonds offer attractive investment opportunities. If inflation expectations worsen, then rates could continue to climb.

GUIDES

The Essential Guide to Retirement Planning

A 4-part series that answers key questions about building your plan, positioning your investments, and more.

Internationally, the European economy has managed to avoid outright recession. Manufacturing has been hurt by the lingering energy crisis brought about by the war in Ukraine as well as weaker demand for exports broadly. Germany and France contracted while Spain and Poland performed well. Consumer spending, easing inflation and lower interest rates should support growth, but the impact of U.S. economic policies is a major question mark.

While the outlook is broadly positive, there are risks to consider. The main theme we see is caution as the trajectory and impact of the incoming administration’s policies is unclear. Trade tensions, conflicts, and political developments could impact global supply chains and consumer confidence, potentially derailing growth and causing market corrections. Finally, although inflation has cooled, supply-side shocks (such as trade wars and tit-for-tat tariffs) could reignite inflation, forcing the Fed to reconsider its dovish stance on interest rates.

Our Portfolios

Our stock exposure is currently broad based and weighted towards large U.S. companies. Though we have reduced our exposure to smaller companies, there is still some under the hood in our core market funds so the underperformance there has been a bit of a drag on returns. Smaller and medium-sized companies offer better valuations than larger companies but can also be more sensitive to economic volatility.

We are well positioned for economic expansion, but if a recession does occur, we would expect our large company stock (and value bias) to hold up somewhat better than the broad stock market. Our international exposure remains balanced between (currency) hedged and unhedged investments and should benefit from more attractive valuations than comparable U.S. equities.

As we noted, the Federal Reserve’s current bias towards lowering interest rates should benefit our bond holdings and expected returns on our bond portfolio going forward will be more attractive than they were two years ago. More importantly, if a recession occurs, interest rates will likely settle back down, resulting in good returns on bonds.

This year, we expect volatility as investors grapple with multiple potential risks and shocks. The possibility of a recession still looms on the horizon, even if the equity markets are signaling that a recession is less likely today than in previous quarters. If periods of volatility occur, we’ll use them to rebalance portfolios and pick up stocks (or bonds) at discounted prices, to better profit from the recovery that has followed every market decline for as long as there have been markets.

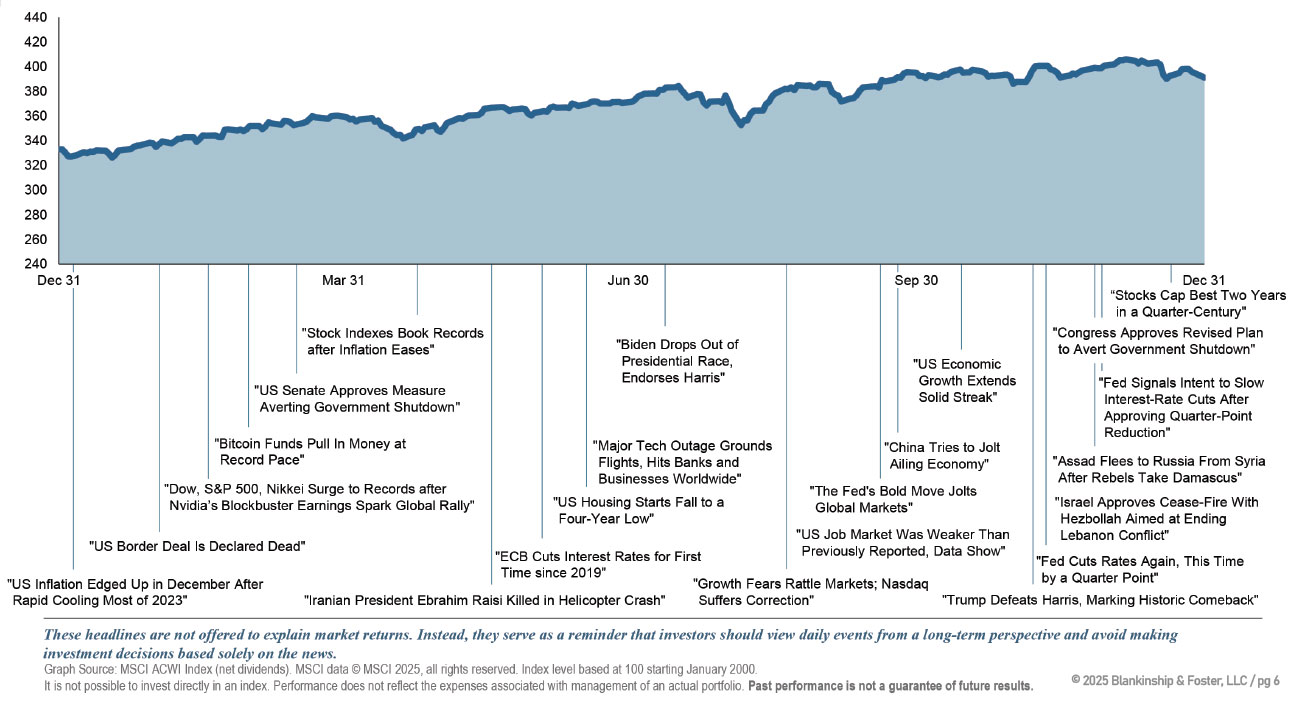

Global Stock Market Performance

The chart below shows the change in global equity markets throughout the quarter. Juxtaposed over the market performance are some of the key events that occurred during the period. Sometimes as we get to the end of a volatile period, it’s difficult to look back and remember everything that happened along the way.

As always, we are here for you and are ready to provide the guidance and planning you expect from us. If you have any questions about your investments or your financial plan, we would love the opportunity to discuss them with you.

Past performance is not an indication of future returns. Information and opinions provided herein reflect the views of the author as of the publication date of this article. Such views and opinions are subject to change at any point and without notice. Some of the information provided herein was obtained from third-party sources believed to be reliable but such information is not guaranteed to be accurate.

The content is being provided for informational purposes only, and nothing within is, or is intended to constitute, investment, tax, or legal advice or a recommendation to buy or sell any types of securities or investments. The author has not considered the investment objectives, financial situation, or particular needs of any individual investor. Any forward-looking statements or forecasts are based on assumptions only, and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. Any assumptions and projections displayed are estimates, hypothetical in nature, and meant to serve solely as a guideline. No investment decision should be made based solely on any information provided herein.

There is a risk of loss from an investment in securities, including the risk of total loss of principal, which an investor will need to be prepared to bear. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular investor’s financial situation or risk tolerance.

Blankinship & Foster is an investment adviser registered with the Securities & Exchange Commission (SEC). However, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Complete information about our services and fees is contained in our Form ADV Part 2A (Disclosure Brochure), a copy of which can be obtained at www.adviserinfo.sec.gov or by calling us at (858) 755-5166, or by visiting our website at www.bfadvisors.com.