Third Quarter 2024 in Review

The U.S. economy accelerated in the second quarter of 2024, clocking in at a 3% annualized rate of growth. At the same time, inflation continues to decelerate on a path towards the Federal Reserve’s 2% target. Slowing inflation combined with a softening labor market allowed the Federal Reserve to cut interest rates at its September meeting, knocking 0.5% off the overnight lending rate. The Atlanta Fed’s GDPNow estimate of growth for the third quarter was at 2.5% as we write this, so it’s possible the Fed may have engineered the mythical soft landing – slowing inflation without sending the economy into reverse. Following the strong employment report at the end of September, Goldman Sachs reduced their recession risk indicator to average.

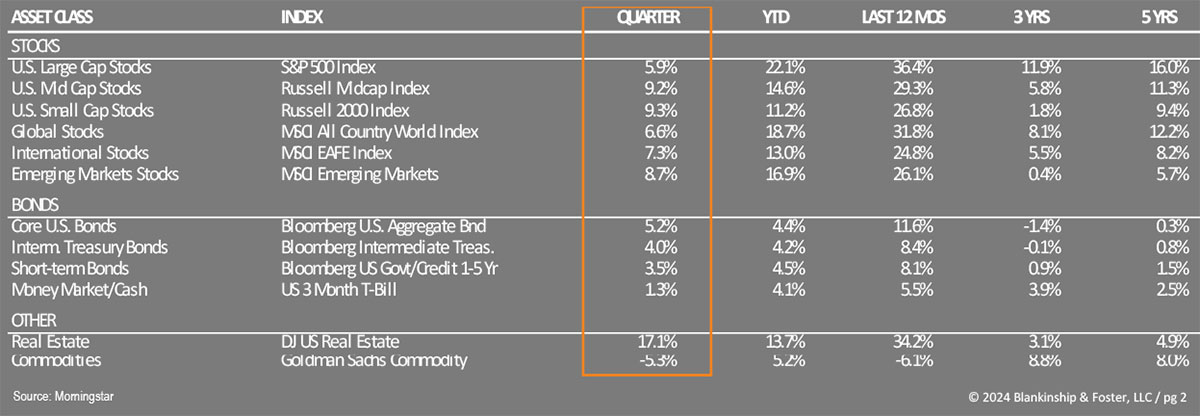

Economic growth, softening oil prices and sustained consumer spending have all been good for the stock market. The S&P 500 Index of large U.S. companies rose 5.9% in the third quarter and is up a solid 22.1% so far this year. Smaller company stocks, represented by the Russell 2000 Index, finally joined the party, gaining 9.3% in the quarter, though still lagging large companies year-to-date. International stocks, represented by the MSCI EAFE index, are up 7.3% for the quarter but also lag large U.S. companies for the year. The benchmark 10-year Treasury yield ended the quarter at 3.81%, down considerably from 4.36% at the end of the second quarter as the Fed’s interest rate cut filtered through the bond market. The Bloomberg US Aggregate Bond Index (representing the entire bond market) gained 5.2% during the quarter (bond prices rise when interest rates fall), offsetting losses earlier in the year.

Alternative investments have been something of a mixed bag. High Yield “junk” bonds have benefitted from the relatively strong economy and improving investor sentiment, gaining 5.3% during the quarter (up 8.0% YTD). Commodities lost 5.3% during the third quarter, largely on the back of falling oil prices; softening global demand outweighed geopolitical risks during the quarter. Commercial real estate, represented by the Dow Jones US Real Estate Index, surged 17.1% during the third quarter as investors began to anticipate lower interest rates (lower financing costs help real estate investors and owners). This erased losses in the first half of the year.

Economy

As we’ve written, Gross Domestic Product (GDP) accelerated following a soft first quarter. Goldman Sachs is estimating 2.8% GDP growth for 2024, somewhat above the long-term trend since 2000. GDP growth accelerated during the third quarter, due in part to companies building up inventory (producing goods to sell later adds to GDP). Strong consumer spending and consumer confidence have contributed to the economic strength, while other indicators remain somewhat more mixed. Still, if a recession is the result of some sector of the economy overheating and causing imbalances elsewhere, it’s hard to see what that might be. Key cyclical indicators like residential construction, business investment, light vehicle sales and business inventories all look healthy. Geopolitical risks remain, but investors seem to be taking those risks in stride for the time being.

The labor market has cooled significantly since the pandemic extremes. Job openings remain elevated, but workers are quitting at more normal rates and layoffs are lower than they’ve been in decades. Perhaps it’s a sign that businesses remain reluctant to lay off workers that were so hard to find a few years ago. While last month’s unemployment report did show unemployment at 4.3% (higher than the recent low of 3.4%), it hasn’t been accompanied by an increase in unemployment claims or layoffs and remains below the 50-year average of 6.2%. The easing job market has also reduced wage growth (and thus upward inflationary pressure).

Speaking of inflation, despite the geopolitical instability, global supply chains have remained calm leading to a downward trend in core prices (excluding volatile food and energy prices). Housing costs (using rents as a proxy for housing inflation) remain high, largely due to a nationwide lack of supply, but there is also a trend of rents leveling off which should help ease inflation going forward. Inflation should continue trending lower, though it may not reach the 2% target set by the Federal Reserve.

Overseas conditions remain mixed. Globally, the stabilization of supply chains and higher interest rates has put pressure on manufacturing heavy economies like China and Germany. China has also been impacted by a sustained slump in real estate prices and ineffective measures by the central government to try to stimulate demand. AI and demand for electronics have spurred growth in Taiwan and Korea. Globally, central banks have begun cutting interest rates, which should help to encourage consumer demand and business investment. Lower interest rates and stabilizing economic conditions should be good for risk assets (stocks) in general.

Outlook

As we head into the fourth quarter during a particularly volatile period, moderate GDP growth with low inflation offers a solid foundation for continued corporate earnings expansion without overheating the economy. This “Goldilocks” scenario—where growth is not too fast to stoke inflation, but not too slow to signal a recession—provides a supportive environment for businesses to thrive. Key sectors like technology, healthcare, and consumer services should continue to benefit from this sustained expansion, particularly as companies continue to invest in innovation and productivity improvements like artificial intelligence (AI) and its supporting infrastructure.

Looking ahead, corporate earnings are expected to continue growing for the foreseeable future. This is largely due to continued productivity gains, cost containment, and favorable demand conditions. However, as stock market valuations rise, particularly in growth-oriented sectors, some investors may question how much further stocks can run. Price-to-earnings ratios, especially in tech and communication services, are climbing into higher territory, suggesting the potential for more tempered gains or pullbacks if earnings growth slows.

The Federal Reserve’s shift to a more accommodative monetary policy, driven by cooling inflation, has brought interest rates down from their recent highs. With the Fed signaling that rate cuts could continue into 2025, the environment for both equities and fixed income looks favorable.

Lower interest rates provide a boost to corporate earnings by reducing borrowing costs and encouraging capital expenditures. Companies with higher debt levels, particularly in capital-intensive industries like real estate, utilities, and industrials, stand to benefit from the reduced cost of financing. Additionally, lower rates tend to make equities more attractive relative to bonds, pushing more capital into the stock market.

For the fixed-income market, lower rates enhance the potential for price appreciation in bond portfolios. Investors can expect better returns on high-quality bonds, especially as falling rates push bond prices higher. This could also mean improved conditions for corporate bonds and other fixed-income securities, offering diversification and income opportunities for conservative investors.

Internationally, the economic recovery in Europe and ongoing industrial growth in emerging markets offer opportunities for global diversification, despite concerns about a widening conflict in the Middle East and the continued war in Ukraine.

While the outlook is broadly positive, there are risks to consider. As corporate earnings surge, stock prices have risen rapidly, particularly in growth sectors. Valuations are starting to stretch, meaning future returns may be more moderate, and volatility could increase if earnings fail to meet lofty expectations. In addition, geopolitical and policy uncertainty abound. Trade tensions, conflicts, and political developments could impact global supply chains and consumer confidence, potentially derailing growth and causing market corrections. Finally, although inflation has cooled, supply-side shocks (such as energy price spikes) could reignite inflation, forcing the Fed to reconsider its dovish stance on interest rates.

A quick word about the upcoming election. It’s important to remember that the outcome of an election is only one of many considerations for investors. In fact, it’s fairly rare for equity markets to fall immediately after an election and rarer still to remain lower throughout a President’s term. Simply put, we do not recommend selling (or buying) stocks simply because of the outcome of a single election. That kind of market timing is rarely successful, especially as it would be based on emotions, rather than data.

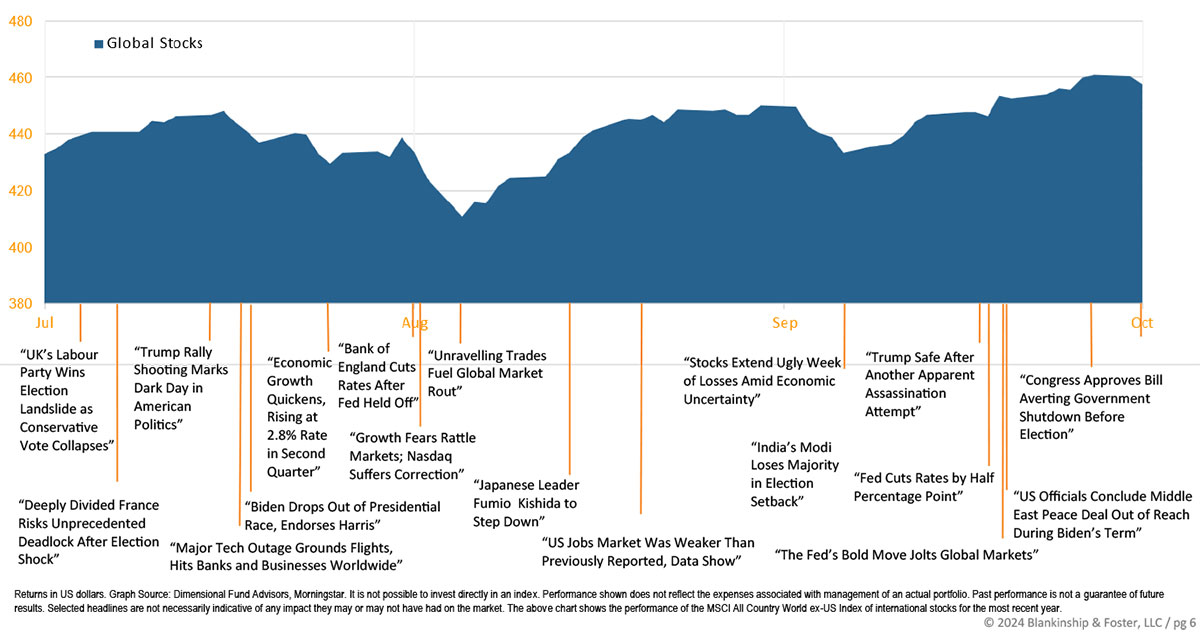

Global Stock Market Performance

The chart below shows the change in global equity markets throughout the quarter. Juxtaposed over the market performance are some of the key events that occurred during the period. Sometimes as we get to the end of a volatile period, it’s difficult to look back and remember everything that happened along the way.

Our Portfolios

Our outlook (and hence our portfolio positioning) hasn’t changed materially in the past several weeks. Our stock exposure is currently broad based and weighted towards large U.S. companies. Though we have reduced our exposure to smaller companies, there is still some under the hood in our core market funds so the underperformance there has been a bit of a drag on returns. We are well positioned for economic expansion, but if a recession does occur, we would expect our large company stock (and value bias) to hold up somewhat better than the broad stock market. Our international exposure remains balanced between hedged and unhedged investments and should benefit from more attractive valuations than comparable U.S. equities.

As we noted, the Federal Reserve’s current bias towards lowering interest rates should benefit our bond holdings and expected returns on our bond portfolio going forward will be more attractive than they were two years ago. More importantly, if a recession occurs, interest rates will likely settle back down, resulting in good returns on bonds.

This year, we expect volatility as investors grapple with multiple potential risks and shocks. The possibility of a recession still looms on the horizon, even if the equity markets are signaling that a recession is less likely today than in previous quarters. We’ll use such periods of volatility to rebalance portfolios and pick up stocks (or bonds) at discounted prices, to better profit from the recovery that has followed every single market decline for as long as there have been markets.

As always, we are here for you and are ready to provide the guidance and planning you expect from us. If you have any questions about your investments or your financial plan, we would love the opportunity to discuss them with you.

Past performance is not an indication of future returns. Information and opinions provided herein reflect the views of the author as of the publication date of this article. Such views and opinions are subject to change at any point and without notice.

Some of the information provided herein was obtained from third-party sources believed to be reliable but such information is not guaranteed to be accurate.

The content is being provided for informational purposes only, and nothing within is, or is intended to constitute, investment, tax, or legal advice or a recommendation to buy or sell any types of securities or investments. The author has not considered the investment objectives, financial situation, or particular needs of any individual investor. Any forward-looking statements or forecasts are based on assumptions only, and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. Any assumptions and projections displayed are estimates, hypothetical in nature, and meant to serve solely as a guideline. No investment decision should be made based solely on any information provided herein.

There is a risk of loss from an investment in securities, including the risk of total loss of the principal, which an investor will need to be prepared to bear. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular investor’s financial situation or risk tolerance.

Blankinship & Foster is an investment adviser registered with the Securities & Exchange Commission (SEC). However, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Complete information about our services and fees is contained in our Form ADV Part 2A (Disclosure Brochure), a copy of which can be obtained at www.adviserinfo.sec.gov or by calling us at (858) 755-5166, or by visiting our website at www.bfadvisors.com.