Quarter in Review

2022 began with mixed expectations: the Omicron wave of COVID infections was receding, while stubbornly high inflation and anticipation of rising interest rates offset otherwise strong economic growth. On February 24, everything changed when Russian tanks invaded neighboring Ukraine, touching off what has been a brutal war. Western sanctions came swiftly, largely cutting off the Russian economy from the rest of the world. On its face, this had little impact on global growth. However, concerns that sanctions could disrupt energy and food supplies from Russia, and the impact of the war on food exports from Ukraine (two of the largest global exporters) have caused increased volatility in commodity markets. While the United States, a net exporter of oil, natural gas, and most food products, is largely insulated from the immediate impact of these disruptions, the impact on global prices has been meaningful.

Global stock markets were already weak in the face of rising interest rates and high inflation. The shock of the conflict in Ukraine resulted in significant short-term volatility. When combined with rising interest rates, there were few assets left with gains for the quarter.

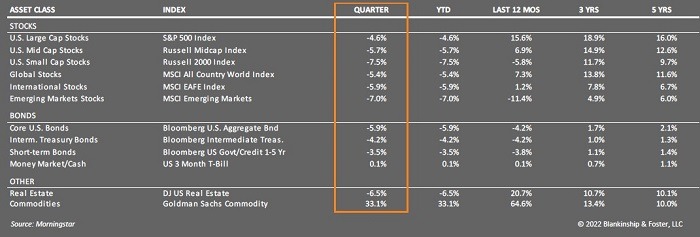

The S&P 500 Index of large company U.S. stocks fell -4.6% during the quarter, though recovered off its lows following Russia’s invasion of Ukraine. Smaller company stocks similarly dropped by -7.5% and international stocks fell -5.9%.

The yield on the 10-year Treasury note began 2022 at 1.52% and rose to 2.32% by the end of the quarter as the Federal Reserve began to raise overnight lending rates. As a result, the Bloomberg U.S. Aggregate Bond index lost -5.9% (when interest rates rise, bond prices fall) in the first quarter. Shorter-maturity bonds held up better, but were still down -3.5%. High yield (“junk”) bonds fell -4.5% and real estate dropped -6.5%. The only bright spots were cash (+0.08%) and commodities (+33.1%) which benefitted from the spike in prices following the invasion.

Fiduciary

We are fiduciaries, and it’s not just a word. It’s a binding commitment to put your interests first.

Economy

Despite the war in Ukraine, rising interest rates and high inflation, the U.S. economy remains strong. GDP Growth in 2021 was 5.7% for the full year and 6.9% in the fourth quarter. Growth is expected to remain strong in the second quarter despite the disruptions caused by Russia’s invasion of Ukraine. The 10 -year Treasury yield rose during the quarter from 1.52% at the end of 2021 to 2.32%. In March, the Federal Reserve Open Market Committee began to raise short-term interest rates, with several more expected this year.

Employment continues to improve, with the unemployment rate at 3.8% and labor force participation for prime age workers near pre-pandemic levels. Even so, there are far more jobs available than there are unemployed workers, even if all of those who left the workforce during the pandemic returned. This has put steady upward pressure on wages. As Baby Boomers retire and birth rates fall, limitations on immigration will continue to put pressure on the labor market and wages.

Rising interest rates will take time to slow the economy, and the Federal Reserve has begun to raise overnight interest rates. Still, higher wages, pent-up demand and strong personal balance sheets and savings suggest the U.S. economy has the potential to weather both higher interest rates and the price shocks we’ve seen from Ukraine, while continuing to grow through the end of the year. Economic growth clocked in at 6.9% (annualized) in the fourth quarter of 2021 and 5.7% for the full year. In fact, the economy has grown back to where it would have been without the COVID pandemic.

Corporate earnings have recovered very strongly since 2019 and continue to set records. Consensus estimates show approximately 10% increase in revenues in 2022. While higher wages will cut into margins, other input costs should be more easily passed through to consumers protecting profit margins.

Overseas conditions are a bit less positive. European countries are far more dependent on exports of Russian energy and other products and are thus much more heavily impacted by sanctions designed to constrict the Russian economy. China has been dealing with a strong COVID outbreak and has imposed aggressive lock-downs that will likely impact economic growth there. Broadly, economic indicators are still positive, but recession risks have definitely risen around the globe as economic activity slows down and prices rise.

Outlook

While recession risks have risen, it is not our base case scenario for a number of reasons. The first is that the U.S., as a net oil exporter, is in a very different position than we were in the 1970’s with the OPEC oil embargo. At that time, energy oil and gas were a much larger share of consumer budgets, and oil imports were a much larger share of Gross Domestic Product. The price shock caused by that embargo had a much greater impact on the economy than the price shock from the war in Ukraine today.

The second reason is that the pandemic is having less of an impact on American consumers and the U.S. economy. According to JPMorgan, the vast majority of Americans have achieved some level of immunity to COVID, either through prior exposure or vaccination. This has enabled consumer and business spending to remain strong despite new waves of the virus, reduced federal fiscal support and rising interest rates. Pent-up demand for goods and services and a tight labor market resulting in higher wages for workers are fueling much of this.

FAQS

We’re happy to answer any questions you have about our firm and our processes. Here are answers to some of the questions we receive most frequently.

High frequency economic indicators like TSA travel, restaurant reservations and hotel occupancy are still increasing. American workers achieved productivity levels not seen in many years as companies have become much more efficient in response to the pandemic.

The question then is whether the economy goes into reverse (a recession) or merely cools to a more modest pace of growth by year-end. Our base case is the latter, but we can’t rule out a downside surprise, either from reduced spending across the economy or a policy mistake like raising interest rates too high.

Slowing growth, higher interest rates and higher inflation should benefit the cheaper, value companies that underly our portfolios. Looking at the economic fundamentals and where interest rates are today, bond yields are much closer to fair value than they have been for a long time.

The war in Ukraine amid a backdrop of already high inflation has certainly increased the uncertainty around any kind of forecast or expectation. Where in the past we viewed the greatest risks to our outlook as a resurgence of the pandemic, we now have to add an escalation of the conflict in Ukraine or a tightening sanctions regime putting additional pressure on food, energy and other commodity prices. Inflation is still expected to moderate during the year, but if it does not, the Federal Reserve may be tempted to act more aggressively, raising the risks of a sharper slow-down in economic activity.

GUIDES

The Essential Guide to Retirement Planning

A 4-part series that answers key questions about building your plan, positioning your investments, and more.

Our Portfolios

Our stock exposure is currently broad based and weighted towards large U.S. companies, which have proven remarkably resilient so far given the fiscal and monetary support over the last two years. Our value orientation should help in the coming weeks as economic conditions favor the industries that tend to make up Value indexes. Despite the most recent quarter, we expect better performance from fixed income during the remainder of the year as interest rates stabilize and bonds reset at the current higher yields.

International stocks represent a particular challenge at the moment, as much better valuations are offset by deteriorating conditions. Growth overseas will continue to be uneven and choppy as COVID continues to present challenges in developing economies. Expansion or escalation of the conflict in Ukraine would further complicate things while some kind of a negotiated settlement could vastly improve prospects.

Our diversifiers have broadly done their part (mitigating losses in fixed income portfolios) and we continue to look for other opportunities to add value for our clients.

As always, we are here for you and are ready to provide the guidance and planning you expect from us. If you have any questions about your investments or your financial plan, we would love the opportunity to discuss them with you.

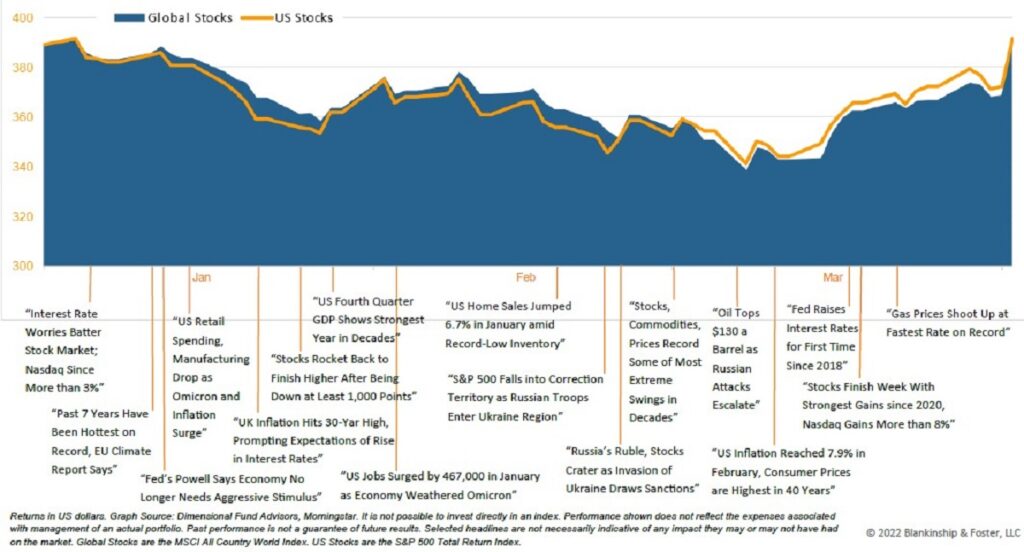

Global Stock Market Performance

The chart below shows the change in global equity markets throughout the quarter. Juxtaposed over the market performance are some of the key events that occurred during the period. Sometimes as we get to the end of a volatile period, it’s difficult to look back and remember everything that happened along the way.

Going Green

We have been working with our technology vendors and are excited to announce that we are able to deliver your quarterly reports to you via our secure online portal. This will help to save paper and is actually more secure, since you can only access the reports through a secure internet connection.

If you would like to save a few trees (and make the reports available whenever you’re ready to read them), then please email your advisor and ask about converting your reports to electronic delivery.

DISCLAIMER:

Past performance is not an indication of future returns. Information and opinions provided herein reflect the views of the author as of the publication date of this article. Such views and opinions are subject to change at any point and without notice. Some of the information provided herein was obtained from third-party sources believed to be reliable but such information is not guaranteed to be accurate.

The content is being provided for informational purposes only, and nothing within is, or is intended to constitute, investment, tax, or legal advice or a recommendation to buy or sell any types of securities or investments. The author has not considered the investment objectives, financial situation, or particular needs of any individual investor. Any forward-looking statements or forecasts are based on assumptions only, and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. Any assumptions and projections displayed are estimates, hypothetical in nature, and meant to serve solely as a guideline. No investment decision should be made based solely on any information provided herein.

There is a risk of loss from an investment in securities, including the risk of total loss of principal, which an investor will need to be prepared to bear. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular investor’s financial situation or risk tolerance.

Blankinship & Foster is an investment adviser registered with the Securities & Exchange Commission (SEC). However, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Complete information about our services and fees is contained in our Form ADV Part 2A (Disclosure Brochure), a copy of which can be obtained at www.adviserinfo.sec.gov or by calling us at (858) 755-5166, or by visiting our website.