Second Quarter 2024 in Review

The U.S. economy has slowed in 2024, but growth remains positive. The economy expanded at an annual rate of 1.6% in the first quarter of 2024 and is on track for a similar result in the second quarter. Inflation has leveled off slightly above 3% in the first half of the year, but most of the components that make up the Consumer Price Index are showing signs of moderating. While unemployment ticked up to 4% in May, it still marked the longest stretch that unemployment remained at or below 4% since the late 1960s. Strong growth in labor supply (especially legal immigration) has helped keep a lid on wage pressures while having little impact on the overall employment picture.

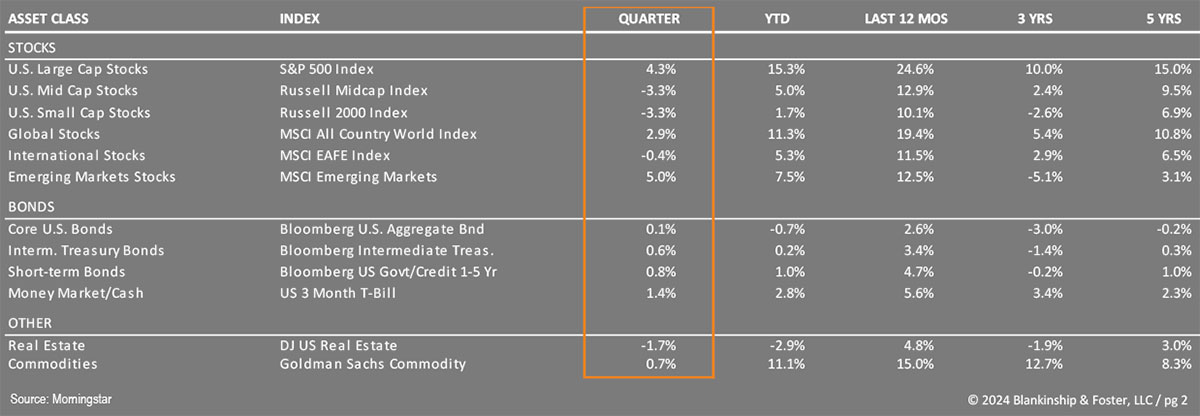

Broad-based economic stability and a surge of capital spending on Artificial Intelligence has driven stock market performance (and investor optimism in general) in the first half of the year. The S&P 500 Index of large U.S. companies has risen 15.3% for the first half of the year. This strong performance belies underlying concerns, however, as the Russell 2000 Index of small company stocks gained only 1.7%. International stocks, represented by the MSCI EAFE index, are up 5.3% in dollar terms but 11.1% in local currency terms (a rising dollar reduces foreign stock performance for U.S. investors). The benchmark 10-year Treasury yield ended the year at 3.88%, but rose as high as 4.7% during the second quarter, ending June at 4.36% as investors worried about inflation leveling off higher than the Federal Reserve’s 2% target. As a result, the Barclay’s US Aggregate Bond Index (representing the entire bond market) was basically flat during the quarter as higher interest payments offset principal losses (bond prices fall when interest rates rise). The index has fallen 0.7% year-to-date while High Yield “junk” bonds gained 1.1% during the quarter (up 2.6% YTD). Commodities were up just 0.7% in the quarter as concerns about economic growth and future demand weighed on prices. Real estate, represented by the Dow Jones US Real Estate Index lost 1.7% in the quarter (2.9% YTD) as investors continue to worry about the potential for rising interest rates and high property vacancies.

Economy

As we’ve written, Gross Domestic Product slowed to a 1.6% annual pace in the first quarter of 2024, slightly below the 2% annual trend since 2000. While decelerating into 2024, growth is likely on track for an annual gain of about 1.5 – 2.0% the year, with the consensus settling into something of a ‘Goldilocks’ expectation for economic growth: not too hot and not too cold, but ‘just right’.

The strong labor market has supported continued consumer spending, but cracks are beginning to show. Auto and credit card delinquencies are rising, though not yet to the levels seen before the 2007 recession. Consumer sentiment remains weak, and spending on non-durable goods like clothing and basic staples has slowed, a sign of stress on lower-income households. Rising real (after inflation) wages supports continued consumer spending and should help to continue the economic expansion.

The final challenge facing consumers is the still-high cost of borrowing, which has kept a lid on activity in the housing market. While there has been some stabilization in housing, supply of homes available to buy remains tight, limiting downward pressure on house prices.

Artificial Intelligence (AI) has driven business capital expenditures, representing about 25% of non-residential capital spending in the past year, according to JP Morgan. This has been reflected in the stock market performance, with the S&P 500 driven by strong gains in almost every AI-related company.

Resilient consumer spending, solid business investment, a still-solid labor market and continued government spending on infrastructure should keep the economy on track for a soft landing into next year. Any downturn in stock markets should be short-lived, barring some kind of economic or policy shock.

Overseas conditions remain mixed. China and Europe continue to look weak, though with some encouraging signs in each. Housing continues to weigh on the Chinese economy, but activity has improved somewhat. Taiwan and Korea have benefitted from the boom in technology spending and India continues to improve.

Outlook

It’s said that the stock market often climbs a wall of worry and investors have much to worry about these days: war continues in Ukraine and the Middle East; volatile oil prices; high housing prices; inflation hovering above 3 percent; mortgage rates above 7 percent; and an ugly presidential election shifting into high gear. Growth is expected to slow during the year, making the economy more susceptible to shocks or policy mistakes. But with the prospect of a recession seemingly reduced, stock markets should continue to rise during the year, though perhaps not at last year’s extraordinary pace.

In equity markets, investors are growing a bit concerned about the concentration of performance in a relatively small number of stocks. The top 10 stocks in the S&P 500 represent almost 40% of the market’s value but only a quarter of the index’s earnings. The Price to Earnings (P/E) ratio of those top ten stocks is roughly 30, compared to 17.6 for the rest of the stocks in the index. This suggests that the strong outperformance of a few high growth names is unlikely to continue much longer.

Fiduciary

We are fiduciaries, and it’s not just a word. It’s a binding commitment to put your interests first.

In the soft-landing scenario, economic growth would slow enough to tame inflation but not enough to cause a recession, resulting in sustained (but very mild) growth, low unemployment and continued strength in consumer spending. If this happens, the Fed may have to cut rates a bit in order to maintain the momentum, but rates could remain higher for longer. Stocks would also benefit from lower short-term rates and improved confidence and would likely see strong gains that are more broad-based than the last few quarters.

If a recession occurs, it would likely result in a sharp drop in stock prices and steep cuts in interest rates as well, so allocations to fixed income (bonds) should somewhat offset losses in stock and real estate holdings. While a recession might be mild or short-lived, the volatility would likely be pronounced, especially since so few stocks have contributed to the gains seen in the S&P 500 this past year.

In the fixed income markets, investors were nearly unanimously expecting much lower interest rates, but have recalibrated their expectations as inflation has remained stubbornly above the 3% level. Currently, investors expect little change in short-term rates before year-end. On the plus side, higher yields on bonds mean that the losses from rising interest rates are better offset by higher income, and if interest rates do fall, there is quite a bit of room to provide bond investors with gains to offset falling stock prices.

Our Portfolios

Our outlook (and hence our portfolio positioning) hasn’t changed materially in the past several weeks. Our stock exposure is currently broad based and weighted towards large U.S. companies. Though we have reduced our exposure to smaller companies, there is still some under the hood in our core market funds so the underperformance there has been a bit of a drag on returns. We are well positioned for economic expansion, but if a recession does occur, we would expect our large company stock (and value bias) to hold up somewhat better than the broad stock market. Our international exposure remains balanced between hedged and unhedged investments and benefits from more attractive valuations than comparable U.S. equities.

Today’s higher interest rates mean that expected bond returns going forward will be more attractive than they were two years ago. More importantly, if a recession occurs, interest rates will likely settle back down, resulting in good returns on bonds.

This year, we expect volatility as investors grapple with multiple potential risks and shocks, including the possibility of a recession. We’ll use such periods of volatility to rebalance portfolios and pick up stocks (or bonds) at discounted prices, to better profit from the recovery that has followed every single market decline for as long as there have been markets.

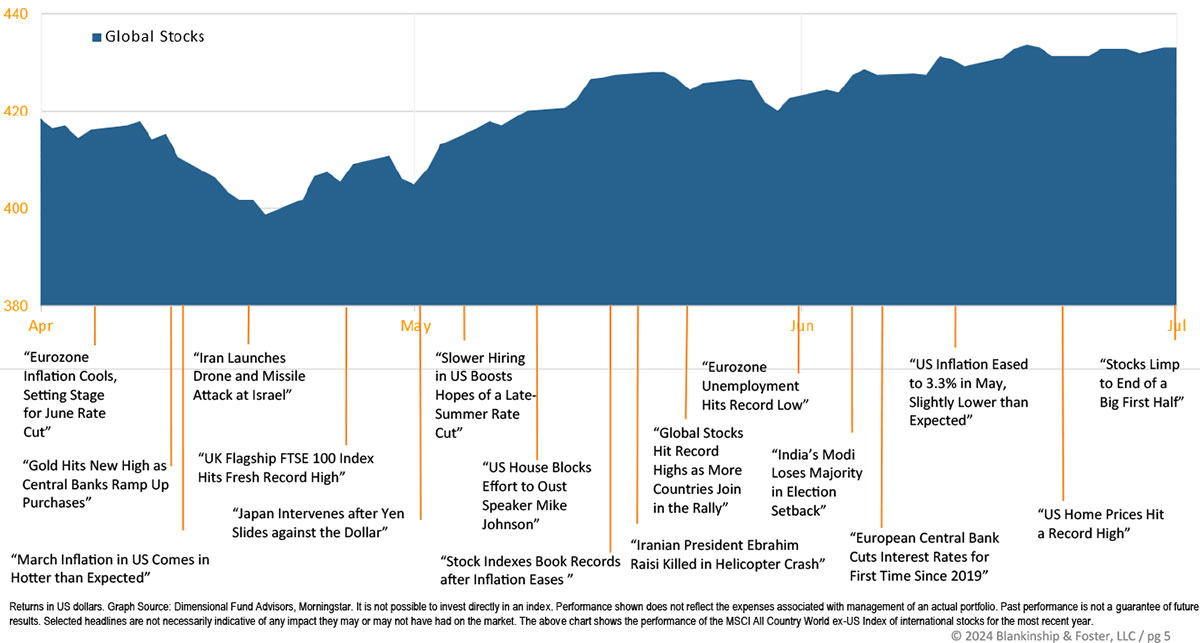

Global Stock Market Performance

The chart below shows the change in global equity markets throughout the quarter. Juxtaposed over the market performance are some of the key events that occurred during the period. Sometimes as we get to the end of a volatile period, it’s difficult to look back and remember everything that happened along the way.

As always, we are here for you and are ready to provide the guidance and planning you expect from us. If you have any questions about your investments or your financial plan, we would love the opportunity to discuss them with you.

Past performance is not an indication of future returns. Information and opinions provided herein reflect the views of the author as of the publication date of this article. Such views and opinions are subject to change at any point and without notice. Some of the information provided herein was obtained from third-party sources believed to be reliable but such information is not guaranteed to be accurate.

The content is being provided for informational purposes only, and nothing within is, or is intended to constitute, investment, tax, or legal advice or a recommendation to buy or sell any types of securities or investments. The author has not consid-ered the investment objectives, financial situation, or particular needs of any individual investor. Any forward-looking statements or forecasts are based on assumptions only, and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. Any assumptions and projections displayed are estimates, hypothetical in nature, and meant to serve solely as a guideline. No investment decision should be made based solely on any information provided herein.

There is a risk of loss from an investment in securities, including the risk of total loss of principal, which an investor will need to be prepared to bear. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular investor’s financial situation or risk tolerance.

Blankinship & Foster is an investment adviser registered with the Securities & Exchange Commission (SEC). However, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Complete information about our services and fees is contained in our Form ADV Part 2A (Disclosure Brochure), a copy of which can be obtained at www.adviserinfo.sec.gov or by calling us at (858) 755-5166, or by visiting our website at www.bfadvisors.com.