Quarter in Review

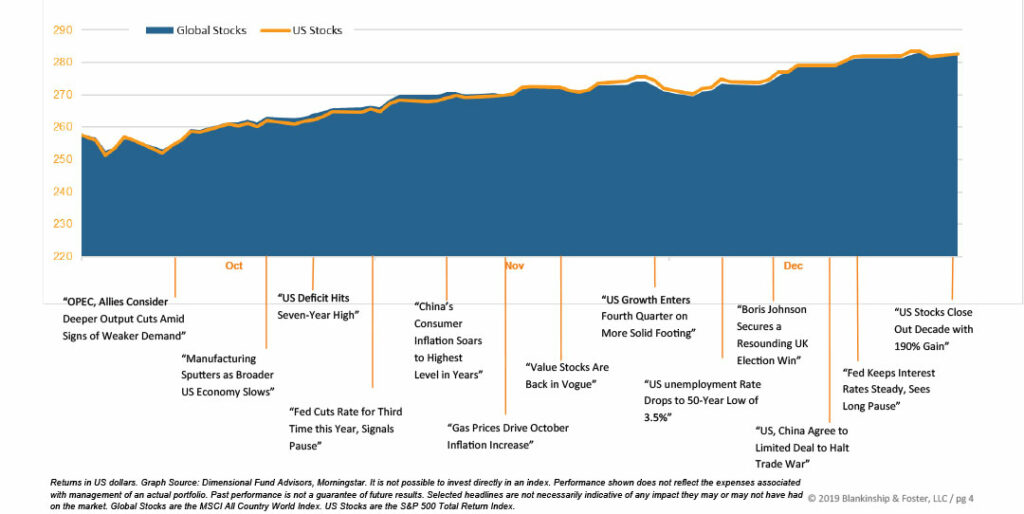

- Easing trade tensions sent investor confidence and asset prices soaring during the quarter despite lackluster economic data.

- Overseas, economic activity remains muted as the global slow-down in growth continues, though encouraging signs are emerging.

- The economy is likely to stabilize at around 2% growth as the “sugar high” from the 2017 tax cuts wears off but payroll gains continue to support consumer spending, which is approximately 70% of the economy.

- The Federal Reserve completed its mid-cycle adjustment after cutting short-term interests rates three times. This reversed the inverted Treasury Yield curve, though there is still little difference between long-term and short-term interest rates.

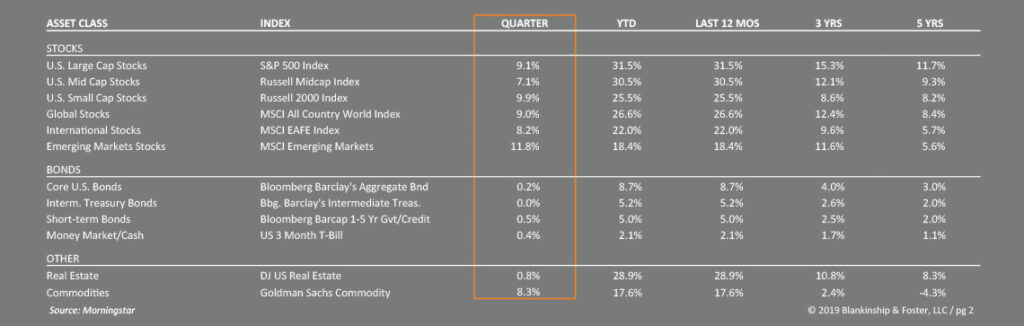

2019 turned out to be a very good year for most capital assets. Stocks and bonds both rallied, despite concerns during the middle of the year that trade tensions could boil over and cause more economic damage. Large U.S. companies, represented by the S&P 500 Index, rose 9.1% for the quarter and 31.5% for the year. Small company stocks performed well, up 25.5% for the year, and international stocks grew 22.0%. Stocks of emerging economies lagged the other categories but were still up a solid 18.4%.

Bonds also rallied during the quarter, which is somewhat unusual. The Barclay’s U.S. Aggregate Bond Index returned 8.7% for the year as the 10-year Treasury yield fell from 2.66% at the beginning of January to 1.9% by December. Real estate performed quite well, up 28.9% for the year, and higher yielding “junk” bonds were up 14.4%. Other alternatives like Master Limited Partnerships (MLPs) and hedge fund strategies broadly lagged.

Economy

Economic growth decelerated to roughly 2% in the third quarter and indicators are pointing towards a similar result for the fourth quarter. Trade tensions earlier in the year likely contributed to weakness in business investment spending, inventory accumulation and exports. Heading into 2020, the fading effects of the 2017 tax cuts should begin putting a bit of a damper on consumer spending. Broadly speaking, economic forecasts are mixed, representing the level of investor uncertainty after a couple of very volatile years and heading into the U.S. election.

An outright recession seems unlikely in 2020, barring a major shock. Despite being more than ten years into the current expansion, the kinds of imbalances that typically precede a recession are not apparent. Normally this late into an expansion, higher interest rates would also be putting a damper on activity, but the Fed Funds rate is currently lower than the rate of inflation, making it still fairly supportive. In addition, the U.S. government is expected to run a deficit of more than $1 Trillion in 2020. This represents about 5% of the U.S. Gross Domestic Product, providing a significant fiscal stimulus for continued growth.

FAQS

We’re happy to answer any questions you have about our firm and our processes. Here are answers to some of the questions we receive most frequently.

The tight labor market is likely to continue, and unemployment could drop further from the current 3.5% rate. This has pushed wages higher as businesses are forced to compete for workers, putting some pressure on corporate profits.

Stock valuations have fluctuated wildly over the past two years, driven by tax cuts, trade tensions, tariffs and weakening economic data. At the end of the quarter, stock valuations were fairly rich, suggesting that improving trade and economic conditions may already be included in U.S. stock prices. That doesn’t leave much room for increasing price to earnings (P/E) multiples. Earnings have been under pressure from a number of factors, suggesting muted returns for stocks as we enter an election year and increased uncertainty.

Outlook

A combination of lower government interest rates and fiscal stimulus, with a dash of improved confidence on the trade front, should allow the global economy to stabilize. Improving conditions overseas and lower U.S. interest rates could even mean a downward trend on the dollar, improving the potential for non-U.S. stocks. As equity valuations outside the U.S. are much more attractive, it bodes well for international investing.

The most important factor in global and U.S. growth has been the trade tensions between the U.S. and China, and the risks were significantly reduced with the modest ‘phase one’ deal. A comprehensive trade deal still seems remote, but the risk of escalation has diminished significantly. Were this to occur, renewed escalation of these tensions could stall the nascent recovery and tip the global economy back towards recession. Our base case is that these tensions ease somewhat, from a low boil to a simmer, for the foreseeable future.

In other parts of the world, Brexit tensions seem to have diminished significantly, reducing the probability of the U.K. crashing out of the European Union without some framework in place. Turmoil in the Middle East threatens to move from background noise to something more disruptive, but so far the markets have largely ignored the situation there.

In summary, there is little upward pressure on global growth, but at least the downward pressure has eased somewhat. Given this dynamic, inflation may run slightly above the Federal Reserve’s current 2% target, but is unlikely to become a serious problem.

Fiduciary

We are fiduciaries, and it’s not just a word. It’s a binding commitment to put your interests first.

Our Portfolios

With stocks and bonds both expensive and policy uncertainty lingering, it pays to remain broadly diversified. Our portfolios are positioned to benefit from increasing stock prices while providing downside protection from increased uncertainty. Minimal inflation pressure and heightened geopolitical tensions should keep a lid on upward interest rate movements, while improving conditions should benefit overseas investments.

Our clients should be prepared for volatility going forward. Without resolution to some of the risks we identified, the upside to equity prices is becoming increasingly limited. We view the current environment with cautious optimism, but the current political climate and the upcoming election could add additional layers of volatility through the end of the year.

As always, if you have specific questions about your investments or your portfolio, we’d love the opportunity to discuss them with you.

Global Stock Market Performance

The chart below shows the change in global equity markets throughout the year. Juxtaposed over the market performance are some of the key events that occurred during the period. Sometimes as we get to the end of a volatile period, it’s difficult to look back and remember everything that happened along the way.