Quarter in Review

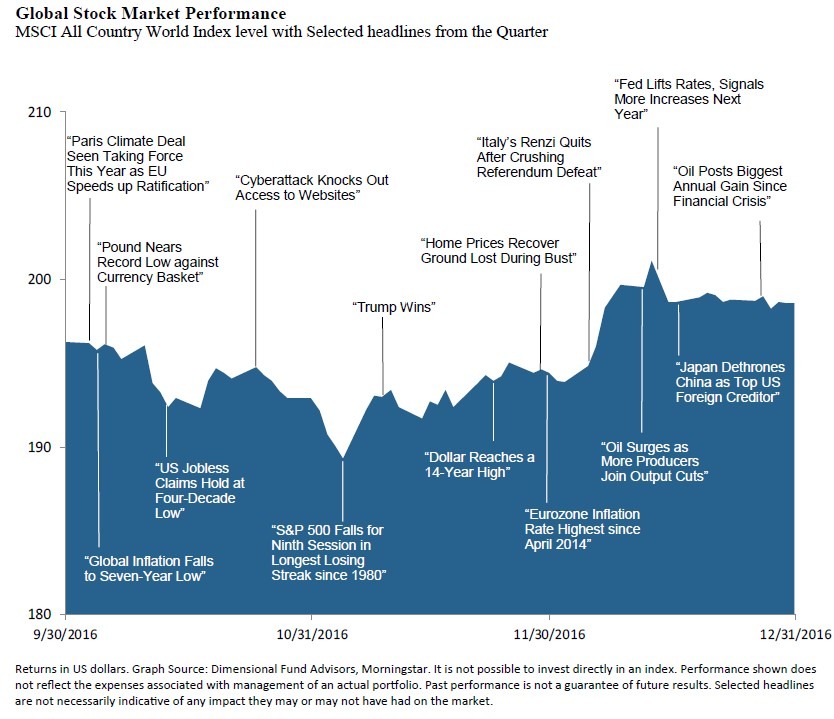

2016 proved to be tumultuous on many fronts. It began with a steep double-digit plunge in stock markets and ended with a six-week equity rally. Fears of rising interest rates, news surrounding oil prices and production cuts, and the political upsets of the Brexit vote and Donald Trump’s victory in the U.S. presidential election spilled over into financial markets. Stocks (and to a lesser extent, bonds) saw wild swings in sentiment and prices as a result.

Amid the volatility, global stocks performed well. U.S. stocks again took the lead, with larger company stocks gaining 12.0% and small-cap stocks surging 21.3%. Developed international stocks gained just 1.0% for the year as strength in the dollar weighed on returns for U.S. investors.

Our currency-hedged international strategy did considerably better: up 6.3% for the year. Emerging-market stocks rebounded strongly after a difficult 2015, gaining 11.2% this past year.

For the full year, the U.S. bond market gained 2.6%, but that hid a 3.0% tumble during the fourth quarter. Sharply rising interest rates produced the worst quarterly performance for bonds in 35 years. Bond losses were compounded by expectations for rising inflation and the Federal Reserve’s December decision to raise overnight interest rates for the first time since August 2015. Short-term bonds held up better during the interest rate spike following the election, and high-yield bonds and other flexible fixed income strategies notched solid gains as well.

Putting the markets’ performance in perspective, we were pleased to see several of our convictions rewarded, especially against the backdrop of such a disconcerting year. Our portfolio positioning for rising interest rates performed as expected, and our stock portfolios performed well, too.

In constructing globally diversified portfolios, we know that there will be periods of time when comparisons to more concentrated portfolios or assets seem unfavorable. This is because diversification inherently mixes several assets together, some of which will be doing well and others struggling. But diversification remains the single most effective long-term risk mitigation tool. It also means gaining exposure to a wider set of investment opportunities, and sticking with them when our analysis convinces us of their favorable long-term return prospects. While some areas of the markets and our portfolios delivered strong performance this year, others were less robust. Since no one can predict ahead of time which market sectors will do well, or for how long, it pays in the long-run to own a wide selection of investments with attractive and differing risk and return drivers.

Where does this leave us? Looking forward, the direction of fiscal and monetary policy is anyone’s guess. The new presidential administration and (to a lesser extent) Republican-controlled Congress have promised to roll back regulations, in addition to providing significant fiscal stimulus by increasing spending while cutting taxes. The markets have rallied strongly on this expectation, though it remains to be seen what actual policies will be delivered.

Given the Federal Reserve’s plan to raise interest rates as a backdrop, it could mean higher debt servicing costs for both consumers and the government (i.e., taxpayers). Also, adding to net government spending when the economy is very close to full employment can put upward pressure on wages and inflation.

Rising interest rates and rising wages could weigh on corporations’ future earnings, while corporate tax cuts and more stable energy prices could help support earnings in the near-term. With price-to-earnings multiples near historic highs, U.S. stocks appear overvalued compared to overseas companies.

After the post-election rally, it seems that quite a lot of positive news is already priced into stock markets today, leaving little room for disappointment. Thus we maintain our slight underweight to U.S. stocks, even though we recognize there is still potential for appreciation. Given the difference in valuations, and expected changes in monetary and fiscal policies both here and abroad, we expect international stocks to outperform U.S. stocks over the next few years.

While acknowledging that the year brings significant uncertainty for the investing environment, as well as with regard to potential tax law and other regulatory changes, we do continue to expect an upward drift in market interest rates, for all of the reasons stated above. If rates do continue rising, we also expect our diversifying strategies to outperform core investment grade bonds.

Lastly, we underscore the importance of viewing investment performance from the perspective of long-term wealth planning. This broader lens is critical in keeping you on track to meet your overall financial and life goals and in not overestimating the impact of any one quarter’s, or even one year’s, returns. We work closely with our clients both in building comprehensive wealth management strategies in addition to investment portfolios suited to their individual needs.

This chart shows the change in global equity markets throughout the quarter. Juxtaposed over the market performance are some of the key events that occurred during the quarter. Sometimes as we get to the end of a volatile period, it’s difficult to look back and remember everything that happened along the way.†

Download this Fourth Quarter 2016 Investment Review as a PDF (1 MB). View reports on past quarters here.