The S&P 500 Index of large U.S. companies gained 14% for the year. On the other hand, U.S. small company stocks dropped more than 13% from their summertime high through mid-October and ended the year up only 5%. Outside the U.S., most major stock markets performed poorly. Developed international stocks lost 5% and emerging markets stocks dropped 2%. These returns reflected the significant headwind presented by the strengthening U.S. dollar. This subtracted nearly 11% from developed international dollar-based returns (compared to their local-currency returns) and more than 7% from emerging markets.

Contrary to market expectations coming into 2014, the 10-year Treasury yield declined and bond prices rose. The Barclay’s Capital Aggregate Index of high quality investment-grade bonds was up 5.8% for the year and municipal bonds also generally fared well. Riskier bond sectors, such as high-yield “junk” bonds or lower quality floating rate loans, struggled.

While our diversified portfolios participated in the strong U.S. stock returns, they faced several headwinds for the year including our investments in foreign stocks and our underweighting of longer maturity, high quality, investment-grade bonds.

Looking Back

As the year drew to a close, a handful of big-picture issues dominated the investment landscape: the plunging price of oil, positive economic indicators in the U.S. relative to most of the globe, and the ongoing influence of central banks (inflating the value of stocks and other risky assets). In the financial markets, the year saw strong gains for the stocks of big U.S. companies and high quality bonds while almost everything else lagged.

Looking at the investment environment, oil prices hit five-and-a-half-year lows in December, falling 40% in the fourth quarter alone. A decline in oil prices is generally considered helpful for the global economy because it benefits consumers and most businesses, and reduces inflationary pressure. However, a sharp plunge could be different given the fragile global economic environment; it intensifies deflationary concerns in Europe and could be an indicator of weak global growth. In Russia, falling oil prices exacerbated an already weak economy, causing the Russian ruble to plunge more than 40% against the dollar and sparking flashbacks of the emerging-markets currency crisis of 1997–1998.

Through all of the angst, global central banks have remained key bastions of calm and stability. The Federal Reserve (Fed) has stated it is on track to begin raising interest rates in the face of U.S. economic improvement. And yet, it once again soothed markets with its December statement reaffirming that it would continue to be patient if U.S. conditions warrant. Given Europe’s weak economy, investors continue to expect the European Central Bank to take a more meaningful step toward full quantitative easing (i.e., purchasing bonds and other assets with the aim of stimulating the economy). In addition, central banks in Japan and China expanded their stimulus efforts over 2014. The key takeaway is that even when Fed begins scaling back its own stimulus, there appears to be plenty of supportive monetary policy globally. Still, as central banks contemplate or continue aggressive stimulus, there’s a reminder that these wouldn’t be necessary if the broader economy were in better shape.

Looking Ahead

In terms of the investment environment, the U.S. economy looks to be in fairly good shape for the near term. The labor market continues to strengthen, inflation remains subdued, manufacturing and other leading indicators suggest solid economic growth, and falling oil prices should boost consumer spending. In addition, government fiscal policy is likely to become less negative as budget cuts are reversed with higher revenues. Monetary policy remains something of a wild card, but based on the Fed’s words and actions, we expect the Fed to raise interest rates slowly; anything else would shock the markets. In short, the economic and monetary backdrop appears broadly supportive over the near term.

Corporate profit growth in this environment has been exceptional, and U.S. stocks may continue to perform well in 2015. However, record earnings trends can’t continue forever and stock prices (valuation multiples) are high. Our analysis continues to indicate that expected returns from U.S. stocks over the next few years are fairly modest (or worse). We won’t eliminate these positions, but we aren’t likely to overweight U.S. stocks any time soon, either.

Europe may offer higher return potential (low double digits in our base case), reflecting our belief that earnings are temporarily depressed and valuations are reasonably attractive. However, we are not increasing our allocation to European or other developed international stocks because we believe the deflation or stagnation risk in Europe still may not be fully priced in.

On the fixed-income side, interest rates have trended lower for the past three-plus decades. Looking over our multi-year investment horizon, we believe higher rates are likely, although the timing and magnitude are uncertain. As such, more than half of our fixed-income exposure remains in opportunistic, flexible, and absolute-return-oriented bond funds.

Finally, it is worth putting recent market results into historical context. This has been an unusually long period of strong performance for large company stocks. Since 1945 there have only been three other periods (out of 51 total) where the S&P 500 has had a longer streak of gains without at least a 10% correction, according to Ned Davis Research. In addition, over the past two years, the S&P 500 has outperformed both developed international and emerging markets indexes by an unusually large margin relative to history. These observations do not mean U.S. stocks must stumble, but this does provide a reminder of the importance of portfolio diversification and prudent risk management; the S&P 500 won’t outperform forever.

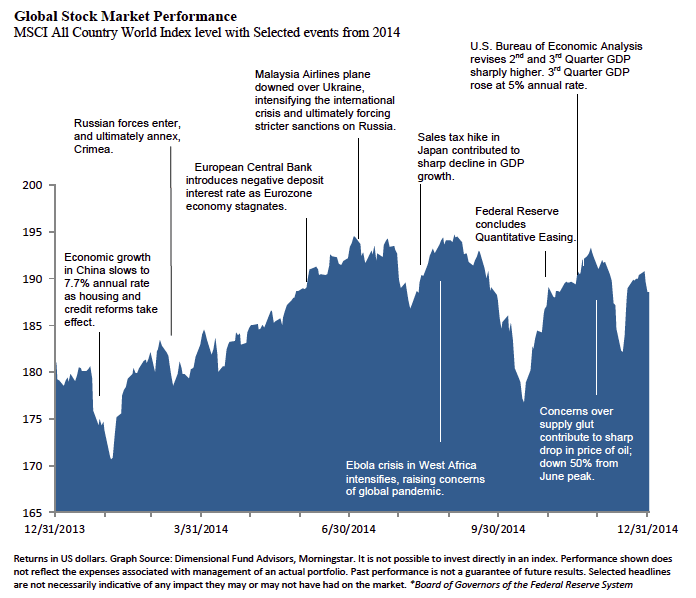

This chart shows the change in global equity markets throughout the quarter. Juxtaposed over the market performance are some of the key events that occurred during the quarter. Sometimes as we get to the end of a volatile period, it’s difficult to look back and remember everything that happened along the way.†

Fourth Quarter 2014 Investment Review Conclusion

One of the themes we see among investors as a group is the tendency to project current market trends into the future. At its most obvious level, this pattern is apparent in the view that U.S. stocks are destined to continue their rally and that developed and emerging markets will continue to disappoint. However, even as we see these biases in the market’s herd-like behavior, we know the past is not a predictor of future performance.

From our vantage point, we would do a disservice to our clients were we to invest based solely on past performance or what may seem superficially attractive today, rather than based on our disciplined analysis of the long-term fundamental drivers of investment results. We are not afraid to construct portfolios that look very different than our benchmarks, so our performance often won’t track the benchmarks we are measured against. Our willingness to do this is a function of our confidence in our investment process, our commitment to do what is right for our clients, and our knowledge that this is what it takes to outperform over the long run.

As always, we appreciate your confidence and welcome questions about your individual situation.

Download this Fourth Quarter 2014 Investment Review report as a PDF (112kb). Visit our archives for reports on past quarters.