The Wall Street consensus is that 2021 will be a good year. As we approach the midpoint of 2021, this is certainly playing out. As more and more Americans are vaccinated against COVID, consumers are feeling more comfortable doing things they’ve put off over the past year. Travel, entertainment, dining out, and other activities are starting to boom as consumers return. When combined with low interest rates, improving global trade and a veritable ocean of government COVID relief spending, conditions are set for more broad-based improvement in economic activity.

It’s great that this consensus view is actually playing out. It doesn’t always work that way though. In fact, basing your investment decisions on the consensus view is more perilous than most people think.

A Trip Down Consensus Lane

In December 2018 the consensus about 2019 was all doom and gloom, as investors focused on slowing growth, interest rate uncertainty, trade tensions with China, and the implementation of Brexit. Despite the nearly unanimous view that 2019 would be an ugly year for the investment markets, it turned out to be a very good year. U.S. stocks gained over 30% and core U.S. bonds gained over 8%.

At the end of 2019, the consensus view for 2020 was very positive. As it turned out, 2020 actually was very positive for most US stocks and bonds — just not in the way that everyone was thinking. If someone had told me there would be a global pandemic that effectively shut the economy down for months, over a half million Americans would die from the pandemic, and the stock market would still hit record highs, I’d have questioned his or her sanity. But that’s what happened, and it illustrates one of the challenges with forecasting. What we think we know isn’t always correct, and what we don’t know can have a big impact.

FAQS

We’re happy to answer any questions you have about our firm and our processes. Here are answers to some of the questions we receive most frequently.

Predictions and Reality

Relying on the predictions of those “smarter than us” is of little help. A study by the International Monetary Fund showed that professional forecasters were only able to predict two of the last 60 recessions while the majority remained undetected. Individual investors fare even worse. While economists and governments ride the train of logic and data over their prediction cliff, individuals often don’t even see the train tracks. In the New York Times bestseller Predictably Irrational, Professor Dan Ariely explains that most people are so irrational that they behave in a very predictable fashion.

And even if you get some things right, things may not go the way you would expect based on your prediction. When you’re investing (or forecasting for any other activity), you need to consider what you may have gotten wrong in your analysis. What are the downside (or upside) risks to your forecast, and what would you do differently if those things happen?

Dealing with Uncertainty

The future is always uncertain, even when we feel certain about upcoming events. Never is this as true as with investing. While the consensus view for the rest of 2021 is very positive, a host of things could cause that view to be wrong.

GUIDES

The Essential Guide to Retirement Planning

A 4-part series that answers key questions about building your plan, positioning your investments, and more.

The most potent tool investors have to deal with uncertainty is diversification. Unless you are required to keep all of your assets in a certain kind of investment (like a foreign stock mutual fund), diversifying is a good way to hedge your bets and prepare for the known and unknown risks.

Sure, you can make a fortune riding a single stock like Amazon or Apple to riches. But if you get your analysis wrong and bet everything on a company like AOL, Yahoo! or Enron, it could go very differently. Diversifying your portfolio reduces your chances for glory and extreme wealth, but it also reduces your risk of disaster.

Does Diversification Work?

Diversification is the act of spreading your investments over a range of assets to reduce investment risk. Diversification is done by allocating assets among classes, such as stocks, bonds or cash. Diversification can be done within investment classes as well, such as owning international stocks and smaller company stocks rather than just the S&P 500.

ACCREDITATIONS & AWARDS

We’re proud to have been honored by some of the organizations in our industry.

In a diversified portfolio, some assets will perform well while others may do poorly. But next year their positions could be reversed, with the former laggards becoming the new winners. Regardless of which asset classes are the winners, a well-diversified stock portfolio tends to earn the market’s average long-term historic return.

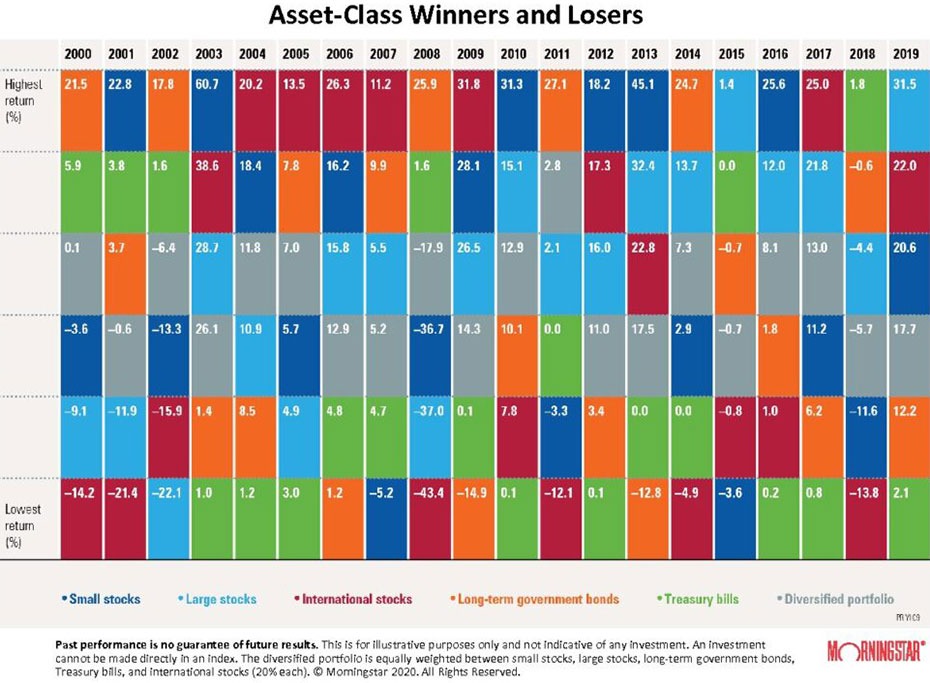

Below, the graphic from Morningstar shows the variability of different types of investments from 2000 to 2019. Navigating the market’s fickle nature, the “asset allocation portfolio” (a diversified portfolio with a mix of investments) stays in the middle of the pack, achieving a strong annualized return while evening out the ride.

Clearly, it makes sense to spread your portfolio around to diversify your risks. Figuring out the mix that works for you is the key to successful investing under any conditions, good or bad.

At Blankinship & Foster, we work with each of our clients to build an investment portfolio that is not only well-diversified, but that is designed to meet their unique situation, goals and objectives. While even a well-diversified portfolio is subject to some uncertainty, we take steps to control risk, minimize costs and taxes, and diligently monitor and re-balance the portfolio. Contact us to learn more about how to Invest With Purpose.