Planning for the Decumulation Phase of life

Among life’s big transitions, the change from working to retirement is one of the biggest. Retirement can bring changes in your lifestyle, your social connections, your day-to day activities. For many, the most significant change retirement brings is in your finances.

Changing Numbers

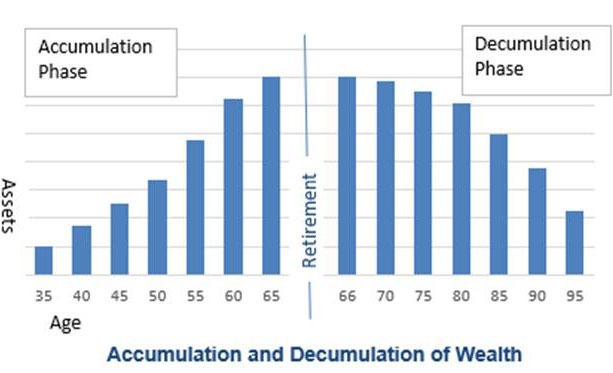

In the working years, it’s all about building wealth. Saving and growing your retirement savings is the name of the game, and the prize is reaching “the number”: the amount of assets you can call “enough” to retire comfortably. This is the accumulation phase.

Once you stop working, “the number” becomes how much you can plan on spending each month. And to know that, you need to know where the money for that spending is going to come from. This is the “Decumulation” stage, where how you distribute your retirement accounts is as important as how you built them.

Decumulation is more complex

While saving for retirement is relatively straightforward, decumulating can be more complex. Distributing the different “buckets” of savings you’ve accumulated (such as IRAs, 401(k)s, and brokerage accounts) requires careful attention. Since income, risk, and taxes all need to be factored into your decisions, the focus of your financial planning changes. Important decisions about pensions, Social Security, and Medicare need to be made.

Investing assets during retirement

Retirement changes the way you think about your money. The stakes are higher now that you’ll be depending on your assets to provide income. Smart investing for retirement means balancing current income, long term growth and stability. Striking this balance can be difficult when the investment markets are volatile, or when safer assets produce less income (such as we’ve seen over the past decade.)

Investing in retirement requires discipline- and a long-term approach that cuts through the noise of current conditions. The key to staying disciplined and maintaining a long-term focus is to know how much of your money you will need to distribute in the next few years and how much can remain invested for a longer time.

GUIDES

The Essential Guide to Retirement Planning

A 4-part series that answers key questions about building your plan, positioning your investments, and more.

The shorter-term part should be subject to less short-term risk, while the longer-term portion can weather market ups and downs and achieve more growth over time. With this discipline, you will be more likely to achieve a sustainable income and maintain your purchasing power over a long retirement.

Coordinating your withdrawal strategy

In the accumulation phase, you may have added money to different types of retirement accounts. Now it’s time to make those accounts work together like instruments in an orchestra. Tax planning is a key consideration. By coordinating taxable income and nontaxable distributions, you can make sure your tax bill stays manageable.

Proper tax planning means not only managing this year’s tax bill, but also considering future taxes as well. In crafting a withdrawal strategy for a retiree, I seek to maintain a balance between pre-tax assets and after-tax assets. Depleting after-tax assets too fast may keep the bill low early on, but it may result in very high taxes later.

Timing the start of Social security, pensions and other income sources also plays a key role.

ACCREDITATIONS & AWARDS

We’re proud to have been honored by some of the organizations in our industry.

Making your cash flow dependable

A well-designed withdrawal plan should provide a steady, predictable flow of money to your checking account. The goal is to maintain your cash flow without unexpected changes.

With a predictable cash flow, you can best manage your expenses. The importance of this job cannot be understated. Managing expenses is perhaps the most important factor to meeting your retirement goals.

Distributing your retirement savings isn’t difficult. Making sure you can sustain those savings over long lives is more complex. This is where a professional advisor can provide a lot of value. As part of our wealth management service, we help you navigate complex information and decisions. We do this by creating bite-sized action plans designed to “Get to How.” To learn more about how we can help you achieve your retirement goals, please contact us.