The Tax Cuts and Jobs Act of 2017 (TCJA) is the most sweeping change to the tax code in three decades. Passed by Congress and signed into law on December 22nd, TCJA permanently modifies taxes for corporations, but it also brings many changes for individuals and small businesses.

With so many modifications across many areas of the tax code, navigating the tax overhaul changes for individuals and businesses will be salient in planning meetings and in upcoming articles and discussions. For now, we’ll discuss several key changes that will likely affect most people’s financial decisions.

With so many modifications across many areas of the tax code, navigating the tax overhaul changes for individuals and businesses will be salient in planning meetings and in upcoming articles and discussions. For now, we’ll discuss several key changes that will likely affect most people’s financial decisions.

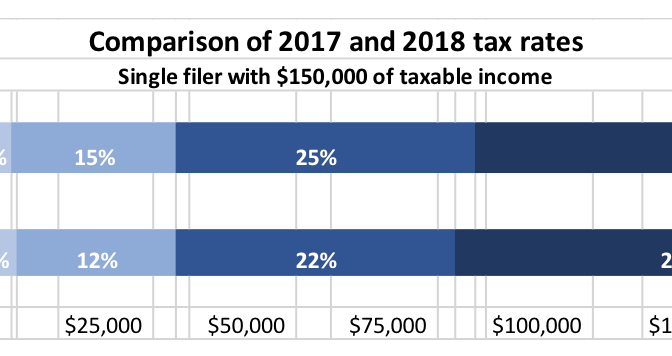

Lower Tax Rates and Brackets

Tax rates were reduced slightly under the new law. The tax brackets are also different, and so slightly more income is taxed at lower brackets. The result is a lower marginal tax bracket for most taxpayers.

Keep in mind, a lower marginal rate doesn’t necessarily mean you will pay less in taxes. Your total tax picture includes the tax effects resulting from the changes in deductions, exemptions, and a host of other factors, a few of which we’ll discuss below.

Tax rates for trusts and estates are also slightly lower. But as before, the brackets are very “steep”: it only takes $12,500 of trust or estate income to reach the top rate. Strategies to distribute trust income to lower tax bracket beneficiaries will continue to be important.

Notably, the Affordable Care Act taxes were not repealed, and so higher income earners will still be subject to them. On the other hand, The Alternative Minimum Tax exemption was increased, so it should be less of a factor going forward.

Investment Dividends and Capital Gain Taxes Unchanged

Capital gains and qualified dividend tax rates will remain the same: 0%, 15%, and 20% on long-term capital gains, and qualified dividends are the same, as are the income thresholds for reaching the 15% and 20% rates. The cost basis rules were also left unchanged—a big relief for investors.

Also, the cost basis rules were left unchanged- a big relief for investors. The “First In First Out” accounting changes proposed in the Senate bill would have caused a big headache for everyone, and we are glad they did not come about.

Increased Standard Deduction

The standard deduction was doubled to $12,000 for individuals and $24,000 for married couples, while personal exemptions were eliminated. The higher standard deduction will eliminate the need for many taxpayers to itemize deductions going forward and will simplify tax preparation for many filers.

Itemizing deductions will still be allowed, but with new limitations on certain deductions (discussed below). The changes in allowable deductions changes some of the tax planning we’ve grown accustomed to, but may present other planning opportunities for high net worth families.

Personal exemptions were eliminated. For many, the higher standard deduction will make up for the loss of personal exemptions. Employers and employees will no doubt have to change their payroll deduction elections, which are based on personal exemptions.

State and Local Taxes (SALT) Deduction Capped

The itemized deductions for state and local taxes and property taxes will be combined into one deduction, and with a cap of $10,000 for individuals and married couples. This limitation will have a significant effect on high income earners and homeowners in high tax states such as California.

Miscellaneous Itemized Deductions Eliminated

The miscellaneous itemized deductions for things like moving expenses, unreimbursed business expenses, tax preparation and investment advisory fees associated with taxable accounts have all been eliminated.

However, investment management fees drawn directly from IRA accounts will continue to be allowed, a valuable tax advantage that allows the fees to be paid with pre-tax dollars. Investors that have professionally managed IRAs and taxable investment accounts should re-evaluate how the advisory fees are being paid, and make adjustments to maximize the tax benefit under the new rules.

Roth IRA Conversion Changes

Roth IRA conversions will continue to be allowed, preserving an important long term tax planning strategy. However, starting in 2018 Roth conversions can no longer be “recharacterized” (reversed)- negating a valuable feature of the Roth Conversion strategy.

It is unclear as of this date whether already-completed 2017 Roth conversions will be eligible to be recharacterized in 2018.

Charitable Contribution Limits Expanded

The deduction for cash donations to public charities will be limited to 60% of the taxpayer’s Adjusted Gross Income (AGI). This is an increase from the previous limit of 50%. The increase will make it easier for those who make substantial charitable contributions to claim a full deduction, and may also help to free up charitable deductions from previous years that had been disallowed because of the 50% limit.

Strategic planning for charitable contributions will become increasingly important going forward. Such planning strategies could include “bunching” of charitable gifts into one year, using vehicles such as donor advised funds and charitable trusts.

Estate Tax Exposure Reduced

The exemption amount for gift and estate taxes was doubled to $11.2 million, and the portability election is still available, increasing the exemption for couples to $22.4 million. The basis step-up provisions and generation-skipping tax rules remain in place. The tax brackets for estates and trusts have also been simplified, with the highest marginal federal income tax rate reduced to 37%.

These changes should make estate tax avoidance strategies unnecessary for most families. Since many older trusts were written with estate tax avoidance in mind, you may want to consult with your estate planning attorney

Much More to Discuss

The Tax Cuts and Jobs Act is the most sweeping change to the tax code in decades. There are dozens of additional changes TCJA brings that are worth discussing and may be relevant to your tax situation. This is meant to be the first of a number of discussions about the how these changes affect your financial outlook.

More than ever, tax planning will be a valuable and beneficial part of managing your finances. As your financial advisors, we will continue to work in collaboration with your tax advisor to optimize your financial and tax planning.

Please do not hesitate to reach out to us if we can be of help in discussing these or other planning matters with you.