First Quarter 2025 in Review

We began 2025 on a relatively solid economic footing with investors showing some optimism for the incoming administration. Unfortunately, things changed in the first quarter. Shifting trade policies, dollar weakness and cooling in technology sector stocks all weighed on the U.S. stock market. The theme for the first quarter was uncertainty. Tariff policy uncertainty, rapid changes to government agencies and spending, and abrupt cuts to existing programs and contracts have all created a sense of unease among consumers, workers and businesses. Consumer and business sentiment has dropped, reflecting the uncertain economic and policy environment. While sentiment surveys do not necessarily foreshadow economic reality, they are indicators that investors watch for hints about future activity.

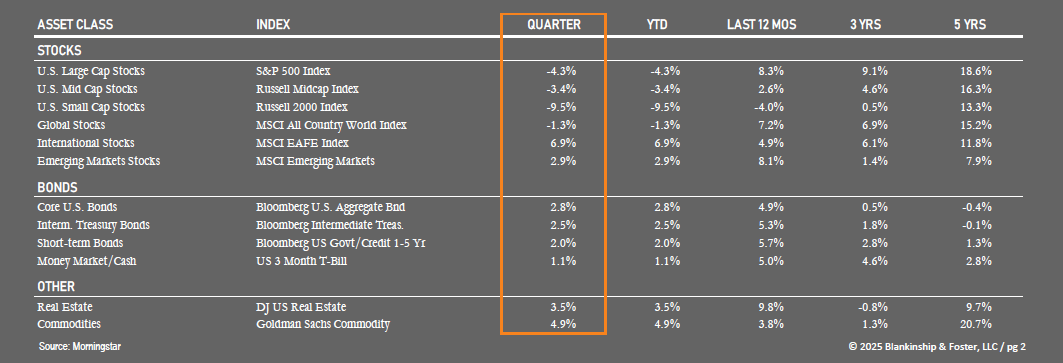

During the first quarter, the S&P 500 index of large U.S. companies shed 4.3%. Stocks began the quarter somewhat expensive, and the large tech companies that powered such strong gains over the past couple of years broadly led the index lower. Smaller company stocks, represented by the Russell 2000 Index, fared worse, down 9.5%.

On the other hand, international stocks shined as European leaders talked seriously about economic stimulus. The MSCI EAFE Index of stocks in developed countries gained 6.9% in the first quarter. Bonds also did well – the benchmark 10-year Treasury yield began the year at 4.57% and dropped to 4.23% as investors shifted to safer assets. The Bloomberg US Aggregate Bond Index (representing the entire bond market) rose 2.8% during the fourth quarter (prices rise as interest rates fall).

Alternative investments were broadly positive. High Yield bonds gained 0.9% during the quarter. Commodities rose 4.9% despite a drop in oil prices. Commercial real estate, represented by the Dow Jones US Real Estate Index, rose 3.5% during the quarter.

Economy

Heading into 2025, it appeared as though the Federal Reserve had managed to raise interest rates just enough to curb inflation without tanking the economy. In 2024, the U.S. economy grew at a 2.8% pace (year-over-year) with estimates in the low 2’s for 2025. In the first quarter of 2025 however, rapid changes in government employment and spending, combined with unpredictable tariff policies jolted both business, consumer and investor confidence. Analysts across Wall Street revised growth expectations lower while increasing inflation forecasts.

Hiring remained solid during the first quarter, averaging about 156,000 per month, but layoffs across the Federal government haven’t really shown up in the data yet. In addition, Goldman Sachs estimates that trade policy uncertainty could reduce non-farm hiring by 20,000 jobs per month, in addition to the 25-30,000 jobs reduction from federal government hiring.

Data showed a surge in imports in the first quarter, likely a result of businesses trying to get ahead of expected tariff announcements. Weaker vehicle and retail sales figures through February reinforce a sense of slowing demand as consumers pull back. It’s clear that the economy hit a pothole in the first quarter, though it remains to be seen whether it’s something more sustained.

Unemployment has so far remained steady around 4% (near historical lows), but if the economy slows significantly, unemployment (a lagging indicator) could rise.

Inflation has come down from its cyclical peak in June 2022 at 9.1%. Headline CPI was 2.4% in March, below expectations. From the Wall Street Journal, “Hotel prices, airline fares and gasoline prices all dropped sharply over the month, a sign that people are canceling their travel plans—one of the first things to go when consumers get nervous.” Broadly, price pressures have been easing, but tariffs could change that.

Tariffs are a tax on imports, and whether a good is made overseas and shipped here, or parts are made overseas and assembled here, the costs are set to increase. The tariffs that have already been implemented have nearly tripled the average import tariff from 2.3% in 2024 to more than 6.4%, according to JP Morgan. Tariffs announced in April would increase that about four-fold. Beyond discouraging imports, tariffs can have negative unintended consequences, too. Tariffs could trigger retaliation and lead to higher inflation. Overall, aggressive tariffs are adding even more uncertainty to an already cloudy economic outlook, complicating the Federal Reserve’s path forward.

Overseas conditions have improved significantly. Banks in Europe and Japan have surged. Defense stocks have also soared following a massive increase in defense spending by the European Union. China is still bogged down by its real estate sector and lackluster growth, but as in the U.S., innovation in technology (especially Artificial Intelligence) has created some enthusiasm among investors. Depressed valuations and the decline in the dollar this year further boosted gains to U.S. investors from international stocks, providing a significant (and somewhat unexpected) diversification benefit as U.S. shares sagged.

Outlook

Since January, the Trump administration has moved aggressively on several fronts. They have begun to cut the federal workforce, planning to cut about 280,000 or so civilian (non-uniform) federal workers, or roughly 10% of the federal workforce of 2.4 million. At the same time, they also halted vast swaths of Federal funding, including research grants, spending on healthcare and education, and other programs that Congress had funded for 2025. While this was going on, the administration tightened border enforcement and began to aggressively deport immigrants. This has effectively halted immigration and cooled the growth in the workforce. Finally, the administration has announced massive new tariffs on all trading partners, though some have been paused for 90 days. Each of these actions individually could probably have been absorbed by a steadily growing economy, especially if they had been rolled out slowly to allow businesses and workers to adjust to the new reality. But rolling all of them out at once has weakened business and consumer confidence and significantly increased the odds of recession this year.

The Federal Reserve, which had been expecting to continue cutting interest rates, is on hold until the impact of these significant policy changes becomes clearer in the data. Higher tariffs could put upward pressure on inflation while slowing economic growth, a situation that changing interest rates cannot fix. Markets have priced in several interest rate cuts, which could happen if the economy slows significantly.

S&P 500 valuations have come down significantly, though not enough to declare the index ‘cheap’ yet. The volatility we’ve seen so far in April has been a direct result of surprisingly aggressive policy moves on the part of the Trump administration and the chaotic rollout of many of these initiatives. Policy uncertainty is a recurring theme on corporate earnings calls and firms may be reluctant to commit to spending on plants, equipment or personnel until there is some sense of clarity and consistency in trade and economic policy. Continued declines in stock prices are possible, though a rapid recovery is also likely if some sense of clarity or structure can be provided to ease concerns.

On the interest rate front, the Federal Reserve has halted its shift to lower interest rates as inflation has leveled off above its 2% target. Bond investors have already pushed longer-term rates higher on expectations of increased government borrowing and higher inflation, although rates may fall as equity investors flee to safer havens. If rates remain where they are, the higher yields on bonds offer attractive investment opportunities.

Internationally, the European economy has surged on increased government spending while the Euro has gained as European interest rates and economic prospects rise. The impact of U.S. economic policies is a major question mark as the EU has vowed to retaliate against the Trump administration’s proposed tariffs.

Thus, the outlook is broadly mixed, with risks tilted towards the downside. President Trump has paused the implementation of his proposed tariffs but insists they are not going away. It remains to be seen if it was bluster for negotiation or a serious policy objective. His positive statements about tariffs and the balance of trade over the past 40 or more years suggest the latter, and that the tariffs will eventually be imposed, and not merely a negotiating ploy. As businesses wait for clarity on trade policy, the economic trajectory is likely downward for the foreseeable future.

GUIDES

The Essential Guide to Retirement Planning

A 4-part series that answers key questions about building your plan, positioning your investments, and more.

Our Portfolios

Our stock exposure is currently broad based and weighted towards large U.S. companies, but our international exposure has been a clear positive so far this year. Though we have reduced our exposure to smaller companies, there is still some under the hood in our core market funds so the underperformance there has been a bit of a drag on returns. Smaller and medium-sized companies offer better valuations than larger companies but can also be more sensitive to economic volatility. Small company stocks have also been battered by the slowing economy and trade uncertainty, as they tend to have less financial flexibility to adapt to changing conditions.

We are well positioned for economic expansion, but if a recession does occur, we would expect our large company stock (and value bias) to hold up somewhat better than the broad stock market. Our international exposure remains balanced between (currency) hedged and unhedged investments and should continue to benefit from more attractive valuations than comparable U.S. equities.

As we noted, the Federal Reserve’s current pause (with a bias towards lowering interest rates) should benefit our bond holdings and expected returns on our bond portfolios going forward will be more attractive than they were three years ago. More importantly, if a recession occurs, interest rates will likely settle back down, resulting in good returns on bonds.

This year, we expect volatility as investors grapple with multiple potential risks and shocks. The possibility of a recession looms greater on the horizon, though this could be eased by more favorable policy and possibly by some clarity as federal budget negotiations progress and a budget bill takes shape. If the uptick of volatility we’ve seen in April continues, we expect to begin harvesting capital losses where we can and rebalance portfolios to pick up stocks (or bonds) at discounted prices. This will allow us to profit from the recovery that has followed every market decline for as long as there have been markets.

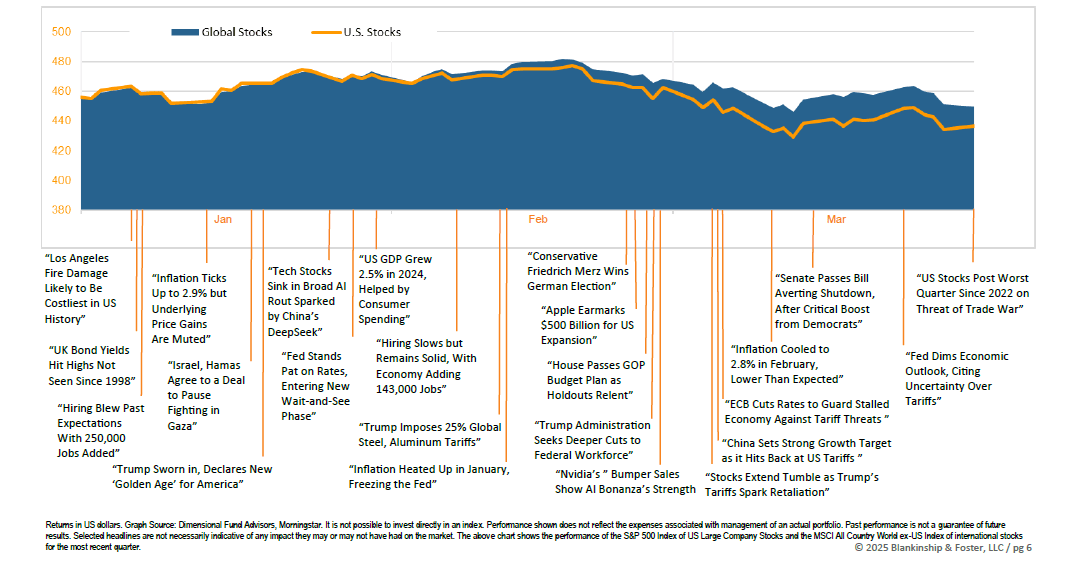

Global Stock Market Performance

The chart below shows the change in global equity markets throughout the quarter. Juxtaposed over the market performance are some of the key events that occurred during the period. Sometimes as we get to the end of a volatile period, it’s difficult to look back and remember everything that happened along the way.

As always, we are here for you and are ready to provide the guidance and planning you expect from us. If you have any questions about your investments or your financial plan, we would love the opportunity to discuss them with you.

Past performance is not an indication of future returns. Information and opinions provided herein reflect the views of the author as of the publication date of this article. Such views and opinions are subject to change at any point and without notice. Some of the information provided herein was obtained from third-party sources believed to be reliable but such information is not guaranteed to be accurate.

The content is being provided for informational purposes only, and nothing within is, or is intended to constitute, investment, tax, or legal advice or a recommendation to buy or sell any types of securities or investments. The author has not considered the investment objectives, financial situation, or particular needs of any individual investor. Any forward-looking statements or forecasts are based on assumptions only, and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. Any assumptions and projections displayed are estimates, hypothetical in nature, and meant to serve solely as a guideline. No investment decision should be made based solely on any information provided herein.

There is a risk of loss from an investment in securities, including the risk of total loss of principal, which an investor will need to be prepared to bear. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular investor’s financial situation or risk tolerance.

Blankinship & Foster is an investment adviser registered with the Securities & Exchange Commission (SEC). However, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Complete information about our services and fees is contained in our Form ADV Part 2A (Disclosure Brochure), a copy of which can be obtained at www.adviserinfo.sec.gov or by calling us at (858) 755-5166, or by visiting our website at www.bfadvisors.com.